Having spoken with quite a lot of trade contributors, it’s clear to me that the big merchants don’t anticipate USDT to depeg. They have a tendency to imagine Tether Inc has greater than sufficient property to cowl its liabilities, although there could also be a length mismatch – ie a few of Tether’s property might not be readily convertible into money (I’ll use the phrase “money” to imply checking account cash in common demand deposit accounts), so if all of Tether’s shoppers needed to redeem their USDT for checking account {dollars} proper now, there wouldn’t be sufficient to go round, and a few of us must wait. To match, retail banks usually can’t deal with clients eager to withdraw greater than 10% of their combination deposits electronically, and even much less bodily!

This piece isn’t about if USDT is totally backed or not, or what would possibly make up the composition of its property, it’s about what would possibly occur if for some cause it did lose its peg.

How would possibly USDT lose its peg?

The peg is maintained by Tether’s shoppers who’re in a position to change between USDT and USD financial institution deposits at 1:1, much less a small charge, versus Tether Inc. Be aware that not all USDT holders are shoppers of Tether. (as an example, I can maintain USDT which I can get from exchanges, defi and so forth, however I’m not a shopper of Tether).

If the market value of USDT falls beneath $1, shoppers should buy USDT out there and redeem every USDT for 1 USD within the financial institution and make a revenue on the distinction. A depeg would solely occur if Tether’s shoppers are unable or unwilling to purchase and redeem USDT. This would possibly occur if:

(1) they imagine USDT shouldn’t be totally backed (ie Tether doesn’t manage to pay for to offer again to the redeemers) or

(2) they imagine Tether’s property exist however are illiquid AND its shoppers are unwilling to tackle the length danger by ready a bit to have their USDT redeemed for USD.

What would possibly occur if Tether loses its peg?

There are just a few results.

First, firms holding USDT on their stability sheet would see the worth of their property fall. Relying on how a lot of their stability sheet is in USDT, this might trigger the corporate to fail. The second order impact right here is that these firms could should promote different property (which can embrace cryptocurrencies) for USD to maintain the enterprise going, which might trigger the worth of these property to fall.

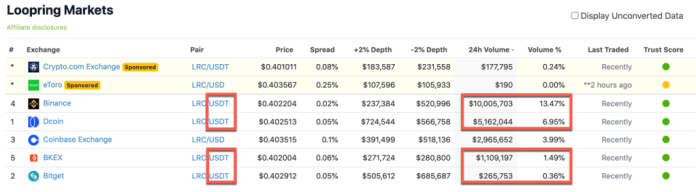

Second, many “long-tail” (ie illiquid, smaller cap) crypto-assets will fall in worth. They haven’t accomplished something fallacious, that is only a consequence of market construction. Lengthy-tail cash are usually priced towards ETH or USDT (not USD) of their most liquid buying and selling pairs, both as a result of they commerce in DeFi swimming pools that have been arrange that approach or as a result of exchanges determined to record them that approach (keep in mind, Binance was authentic crypto-only and so listed cash towards USDT quite than USD).

All else being equal, when the worth of USDT falls, the worth of those long-tail property fall too. When you don’t intuitively get this, take into consideration oil and USD – when USD falls, and the oil/USD value doesn’t change, the worth of oil in your native (non-USD) foreign money additionally decreases. Or in case you’re crypto native, then you definately intuitively know that when ETH falls, all of the ETH-priced shitcoins fall too even they haven’t accomplished something fallacious.

This might additionally trigger a little bit of pricing chaos if some information suppliers don’t differentiate between the USD value of an asset vs the USDT value (as the worth in USDT of enormous cap property ought to enhance).

Third, and I feel it is a small impact but it surely’s my favorite: speculators who’ve lent USDT as collateral to borrow cryptocurrencies (most definitely to quick them) could get margin referred to as and their quick positions could turn out to be liquidated inflicting a brief squeeze and presumably pushing up the worth of these crypto property 🙂