Briefly

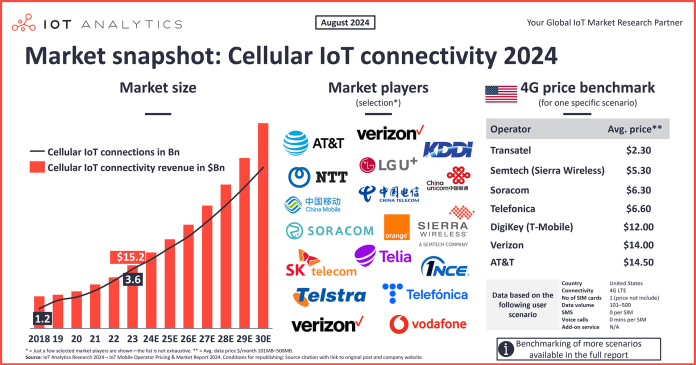

- There have been 3.6 billion lively mobile IoT connections in 2023, roughly 21% of world IoT connections, in keeping with the 159-page IoT Cellular Operator Pricing and Market Report 2024–2030 and its accompanying cellular operator database.

- Two IoT cellular operator varieties present mobile IoT connectivity: cellular community operators (MNOs) and cellular digital community operators (MVNOs).

- A benchmark of the 2 varieties exhibits that MVNO IoT providers price considerably lower than MNO IoT providers on account of decrease overhead, however MNOs stay aggressive with value-added providers and numerous choices.

- IoT Analytics put collectively an in depth database of IoT cellular operator pricing plans and picked 2 particular situations for a typical 4G connectivity end-user situation, displaying Verizon (native MNO) and Transatel (MVNO) having the most cost effective service within the U.S., whereas Telefónica (MNO) and Onomondo (MVNO) are the most cost effective in Germany for a similar situation.

Why it issues?

- For IoT cellular operators: Within the dynamic mobile IoT connectivity market, it is very important control the costs and choices of opponents.

- For mobile IoT adopters: Benchmarking MNOs and MVNOs worldwide is essential to make sure the perfect “worth for cash.”

Mobile IoT market overview

Mobile IoT connections surpassed 3 billion in 2023. Based on the 159-page IoT Cellular Operator Pricing and Market Report 2024–2030 and its accompanying cellular operator database* (each revealed in July 2024), international lively mobile IoT connections grew by 24% to three.6 billion lively connections in 2023. World mobile IoT income doubled between 2018 and 2023 (from $7.7 billion to $15.2 billion) and is anticipated to achieve $49 billion by 2030, reflecting a CAGR of 18%. IoT connectivity made up 1.3% of world cellular operator income in 2023, effectively behind different sources of income for many operators (e.g., paid cell phone plans); nonetheless, this quantity is anticipated to rise to three.2% by 2030.

Notice: The Cellular Operator Database is out there with Staff Consumer and Enterprise Premium licenses.

This text relies on insights from:

IoT Cellular Operator Pricing and Market Report 2024-2030

Obtain the pattern to study extra concerning the report construction, choose definitions, scope of analysis, market information included, corporations included, and extra information factors.

Already a subscriber? See your experiences right here →

Mobile IoT connectivity market panorama

2 IoT cellular operator varieties present mobile IoT connectivity. The market is cut up between cellular community operators (MNOs) and cellular digital community operators (MVNOs). These two cellular operator varieties present mobile IoT connectivity providers instantly to finish customers and are the one sort of community operators the report focuses on. MNOs present the bodily, licensed community infrastructure and provide providers from this infrastructure. MVNOs leverage the license and capability of the MNOs to supply their very own providers. As such, a share of the income for MVNOs’ IoT connectivity providers contributes to the income of MNOs. For instance, Japan-based MVNO Soracom—acquired by Japan-based telecommunications firm KDDI in 2017—leverages the community infrastructure of main US carriers, equivalent to AT&T, Verizon, and T-Cellular, for its mobile IoT providers within the US.

Benchmarking IoT cellular operators: MNOs vs MVNOs

Finish-user preferences fluctuate. Some end-users see IoT connectivity as a commodity and search essentially the most budget-friendly providers. Others have extra necessities, equivalent to excessive information limits with information pooling providers, decrease latency, and administration of large-scale IoT deployments, and thus search tailor-made providers, making the choice extra complicated.

Primarily based on the IoT cellular operator database, a benchmark of MNOs and MVNOs is under, highlighting the advantages and choices that make them aggressive within the mobile IoT market.

MVNOs provide considerably decrease costs on common. The evaluation within the IoT Cellular Operator Pricing and Market Report in contrast 150 IoT information plans from over 20 cellular operators worldwide (all of which could be discovered within the report’s accompanying database). Utilizing 4G LTE because the connectivity commonplace and 101–500 MB of knowledge band for reference, on common, cellular operators provide ~32% cheaper pricing than MNOs. For instance, when evaluating commonplace data-only plans, the typical month-to-month price per SIM for MNOs worldwide was $7.30, whereas the typical price for MVNOs worldwide was $4.98, a distinction of 32%.

How MVNOs provide decrease costs for IoT connectivity

Decrease overhead aids in MVNOs’ decrease costs. MVNOs function on MNOs’ community infrastructure, which itself incurs capital expenditure (CAPEX) for MNOs to construct and keep. MNOs recuperate the prices related to constructing and sustaining by way of larger plan costs, however since MNVOs don’t have to construct and keep such infrastructure, they don’t incur these prices. This a lot decrease overhead permits MVNOs to maintain their margins—and thus their costs—low. Within the UK, a number of MVNOs, equivalent to VOXI, Asda Cellular, Lebara, and Talkmobile, function on UK-based MNO Vodafone‘s community infrastructure.

MVNOs typically have modest choices. MVNO IoT service choices have a tendency to offer extra barebone choices than MNO plans—decrease information limits or fewer information choices, for instance. Whereas this helps preserve prices down for the subscriber, it may also be limiting relying on their wants, equivalent to these needing larger information limits or extra versatile information choices. For example, as proven within the IoT cellular operator database, Japan-based MVNO Soracom and US-based MVNO Semtech (Previously Sierra Wi-fi) sometimes provide plans with round 1 GB of knowledge or much less, which can fulfill the wants of subscribers with low information wants however will not be sufficient for others.

How MNOs stay aggressive at larger IoT service costs

MNOs provide better-tailored providers. For subscribers who want extra information, extra versatile information restrict choices, quicker speeds, or larger prioritization, MNOs can tailor IoT connectivity plans to suit these wants since they personal the community infrastructure and capability. MNOs can provide tiered service ranges to match the wants of their subscribers, from excessive efficiency and information to decrease, extra budget-friendly packages. Examples of tiered information service ranges are Spain-based MNO Telefónica, providing a Enterprise Excessive IoT plan with as much as 500GB within the EU, and Australia-based MNO Telstra, providing plans between 100GB and 1TB of knowledge.

MNOs provide value-added providers. To sweeten their IoT service plans, many MNOs have strategically shifted their focus from offering pure connectivity providers solely to offering extra end-to-end options by collaborating with {hardware} gamers, chipmakers, or software program distributors. For instance, China Cellular—the world’s high IoT cellular operator by connection and income—provides a one-stop answer technique encompassing {hardware} elements like chips, working programs, and modules. The technique additionally integrates with three of China Cellular’s IoT platforms—OneLink, OneNET, and OneCyber—and targets three important areas of software: video-based IoT, city IoT, and industrial IoT. In the meantime, Germany-based MNO Deutsche Telekom provides IoT detection options, which give excessive visibility of the IoT gadgets roaming in overseas networks and permit operators to estimate the revenues and prices.

MNOs resolve information visitors prioritization. Whereas MVNOs function on MNOs’ extra community capability (which means they pay decrease costs for that capability), MNOs could maintain the precise to prioritize their subscribers’ information over that of the MVNO subscribers. For example, T-Cellular US prioritizes information for patrons on most T-Cellular branded plans earlier than the info of consumers on Metro by T-Cellular plans or Assurance Wi-fi-branded plans, that are digital wi-fi service suppliers owned by T-Cellular US.

Overview of IoT cellular operator pricing fashions and billing parameters

IoT cellular operators leverage 3 important pricing fashions and 15 important billing parameters. Mobile IoT worth plans differ between IoT cellular operators, as they’re typically structured on pricing fashions and billing parameters. By way of pricing fashions, there are usually 3 fashions that cellular operators could provide:

- Time-based – Subscribers pay a set payment for a pre-allocated information restrict no matter whether or not they used all their allotments.

- Utilization-based – Subscribers pay a variable payment primarily based on the quantity of knowledge consumed.

- Time + usage-based – Subscribers pay a hard and fast, recurring payment for a pre-allocated information restrict, with extra prices for information utilization past the pre-allocated restrict.

For billing parameters, the report identifies 15 that operators could use to find out the associated fee and contract phrases for subscriptions, together with billing cycle, information pace, SIM service prices, and add-on providers.

IoT pricing benchmarks

With 7 completely different mobile applied sciences in focus, 170 completely different nations, and 15 completely different billing parameters—every with completely different tiers—there are numerous potential pricing combos. The IoT cellular operator database incorporates 150+ information plans and permits for custom-made benchmarking. Beneath, MNOs and MVNOs are in contrast in a particular situation the place one IoT machine consumes 100 MB monthly on 4G LTE information with no extra information pooling and no extra gadgets.

Notice: The database consists of over 150 plans from over 20 key IoT cellular operators. There are extra plans from extra operators; nonetheless, the IoT Analytics crew confined their evaluation to info that was publicly and available between December 2023 and February 2024.

US benchmark

The most cost effective MVNO is 84% cheaper than the most cost effective native MNO within the US. Within the situation above, the bottom base charge for a neighborhood MNO is $14 monthly per SIM from Verizon. In the meantime, for MVNOs, Transatel and Soracom provide the most cost effective base charges of $2.30 monthly and $4.40 monthly, respectively. Of observe, Telefónica USA is essentially the most inexpensive MNO at $6.60, nevertheless it doesn’t personal any infrastructure within the US and depends on roaming agreements with native MNOs.

- Additional about Verizon’s IoT information plan: Verizon makes use of a time-based billing mannequin and provides a triple-punch SIM card—which means the SIM could be diminished to smaller kind elements (2FF, 3FF, and 4FF) to suit gadgets as wanted—for $1.50 per SIM, which is right for scalability.

- Additional about Soracom’s IoT information plan: Soracom leverages US-based MNO AT&T’s community for its IoT connectivity. It makes use of the time + usage-based pricing mannequin and prices an extra overage payment of $1.50 per MB when the primary 100 MB is reached. SIM playing cards are included.

- Additional about Transatel’s IoT information plan: Transatel leverages Japan-based MNO NTT’s infrastructure for its core community and provides IoT connectivity. It makes use of the time-based pricing mannequin but additionally provides usage-based pricing with an extra mounted payment of $1.80 per lively SIM as connection prices (SIM playing cards are included). It permits clients to make use of a single SIM for each non-public community wants and international roaming. There’s additionally a dedication to maintain the SIM lively for a 12-month interval.

Germany benchmark

The most cost effective MVNO is 83% cheaper than the most cost effective MNO in Germany. In the identical situation, Spain-based MNO Telefónica provides the bottom base charge at $4.40 monthly per machine. In the meantime, Denmark-based Onomondo provides a per-MB charge of $0.004 and features a month-to-month payment of $0.33 for each activated SIM. For 100 MB of knowledge, this involves $0.73 monthly per SIM.

- Additional about Telefónica’s IoT information plan: Telefónica makes use of a time + usage-based pricing mannequin and prices an extra $0.08 per MB over the bottom 100 MB. It provides commonplace SIM playing cards (2FF, 3FF, and 4FF) costing $2.19 per SIM and provides 2FF SIM playing cards for industrial functions for $3.29 per SIM.

- Additional about Onomondo’s IoT information plan: Onomondo provides a usage-based pricing plan with no extra SIM card prices. The corporate additionally doesn’t cost a month-to-month payment for SIM activation. All SIMs are delivered activated and are solely charged when information is transmitted. The corporate provides commonplace SIM and industrial SIM playing cards with kind elements equivalent to 2FF, 3FF, and 4FF, in addition to embedded SIM (eSIM) and SoftSIM. Presently, the SoftSIM solely helps the nRF91 collection mobile IoT module from Nordic Semiconductors and the LTE Cat-1 module from Quectel.

Extra info and additional studying

Are you interested by studying extra concerning the newest IoT connectivity insights?

IoT Cellular Operator Pricing and Market Report 2024-2030

A 159-page IoT cellular operator market report detailing market dimension & outlook, aggressive panorama, connectivity varieties, information plans, MNO/MVNO choices, and IoT pricing benchmark.

Already a subscriber? See your experiences right here →

Associated experiences

You might also have an interest within the following experiences:

Associated dashboard and trackers

You might also have an interest within the following dashboards and trackers:

Associated articles

You might also have an interest within the following articles:

Subscribe to our e-newsletter and comply with us on LinkedIn and Twitter to remain up-to-date on the newest tendencies shaping the IoT markets. For full enterprise IoT protection with entry to all of IoT Analytics’ paid content material & experiences together with devoted analyst time try Enterprise subscription.