Briefly

- 22% of just lately introduced cloud implementations had an AI component, in response to the 188-page International Cloud Tasks Report and Database 2024. The information exhibits that AI has grow to be a driver for cloud demand, with generative AI (GenAI) enjoying an rising function.

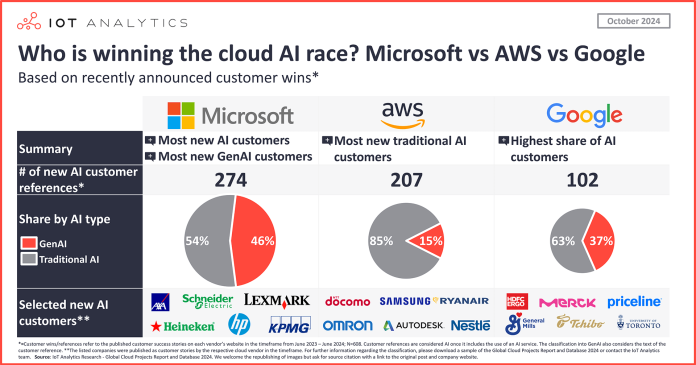

- In keeping with the information, Microsoft is main the general AI and GenAI race. AWS leads in conventional AI, whereas Google has the best share of AI clients.

Why it issues

- For cloud AI suppliers: The evaluation and related report/database give insights concerning the present aggressive panorama and the place clients are on the lookout for cloud AI assist.

- For cloud AI adopters: Understanding the present choices and the way distributors are creating their cloud AI choices can inform present and future enterprise AI tasks.

State of cloud AI tasks in 2024

A fifth of cloud implementations now have an AI component. The 188-page International Cloud Tasks Report and Database 2024 (printed October 2024) exhibits that between June 2023 and June 2024, over 2,700 new buyer case research had been printed by the highest 5 international hyperscalers, 608 of which use a cloud AI service (22%). The report analyzes over 8,300 buyer implementations of the most important cloud distributors of latest years (together with deep dives on AI and IoT cloud tasks).

Curiosity in enterprise AI rising. AI has been a expertise of curiosity to enterprises for years, although it has remained out of the highest 10 priorities till 2021. It’s now a high 5 enterprise expertise precedence. Supporting that is the surge in CEO boardroom discussions about AI. Actually, in Q3 2024, solely the subject of inflation surpassed AI in these discussions.

As CEOs speak about AI, their groups use cloud AI expertise (Instance: Intuit). With widespread pleasure about generative AI (GenAI), executives haven’t been shy about discussing a few of their firm’s AI initiatives in depth. For instance, in Q2 2024, Mark Notarainni— Intuit’s chief buyer success officer and govt VP—mentioned how the corporate is embedding GenAI options in its accounting software program:

“Generative AI is definitely a sport changer for us in how one can assist clients get ready for taxes by getting their paperwork for them, doing work on these paperwork as you acquire these within the platform and shifting our assisted experiences to be way more about advisory and decision-making and nearly eliminating the information entry facet of it, which is the place the normal market is.”

Mark Notarainni, Chief buyer success officer and the manager VP at Intuit (June 2024)

The worldwide cloud undertaking report’s accompanying database* exhibits that Intuit is only one of 500 corporations which were constructing their AI stack on high of the AWS cloud, utilizing instruments comparable to AWS Bedrock and AWS SageMaker along with different AWS instruments for the underlying information analytics infrastructure, comparable to AWS Kinesis.

*Word: The Excel file of over 8,000 cloud tasks is accessible for buy with Staff Consumer and Enterprise Premium licenses.

How consultant is the cloud tasks report 2024?

The insights from this text are based mostly on information from the International Cloud Tasks Report and Database 2024, A structured repository of 8,374 tasks from 5 of the most important cloud distributors, accompanied by a 188-page report analyzing buyer implementations, together with a deep dive into IoT and GenAI cloud tasks.

Obtain a pattern to be taught extra concerning the report construction, choose definitions, choose market information, further information factors, and developments.

Already a subscriber? Browse your studies right here →

The cloud undertaking report aggregates all 8,374 publicly identified cloud implementations thus far in a single database. Though there are tens of 1000’s of extra tasks that haven’t been made publicly accessible, the information seems consultant sufficient to attract conclusions relating to the enterprise footprint for every of the 5 distributors and particularly their AI enterprise. The desk beneath exhibits the 2023 public cloud market share (in response to IoT Analytics’ personal mannequin) in comparison with the share of public buyer references (for public cloud and new cloud AI tasks) within the database that accompanies the report.

| Firm | 2023 market share | Share of public cloud tasks in database | Share of recent public cloud AI tasks |

|---|---|---|---|

| AWS | 37% | 38% | 34% |

| Microsoft | 29% | 28% | 45% |

| 9% | 20% | 17% | |

| Others | 7% | 14% | 4% |

The share of total cloud and cloud AI tasks within the checklist is basically similar to the precise market share of the distributors (though some deviations stay). The information gives a complete snapshot of how the client footprint of those corporations varies by business, area, and buyer measurement, they usually reveal some key clients in every vertical. IoT Analytics was additionally in a position to confirm with varied consultants within the area that the 2023 model of the worldwide cloud tasks report gave the impression to be consultant of the particular buyer footprint of those distributors.

Definition and methodology

General cloud tasks

The general cloud undertaking database of over 8,300 tasks is a compilation of all publicly identified cloud buyer references from the 5 main cloud distributors on their respective cloud success story web sites: AWS, Microsoft, Google, Oracle, and Alibaba. All tasks within the checklist symbolize public data and had been printed on the respective distributors’ web sites as of June 2024. To be included, a undertaking should contain not less than one public cloud Infrastructure-as-a-Service (IaaS) or cloud Platform-as-a-Service (PaaS) service. Pure Software program-as-a-Service (SaaS) buyer tasks had been excluded.

AI and GenAI tasks

By way of AI, all case research that comprise not less than one AI/ML product are thought of “AI” for the needs of this text. For GenAI, case research are labeled through a mixture of merchandise included within the case examine (i.e., Amazon Bedrock/Azure OpenAI) and key phrases talked about in the primary textual content of every case examine.

Evaluating the hyperscalers’ new cloud AI choices: Microsoft vs. AWS vs. Google

1. All cloud AI tasks

Whole variety of AI case research

Microsoft has added probably the most AI case research. Among the many 608 new cloud AI case research, Microsoft had probably the most, with 274 case research recognized (45% of the 608). New AI buyer wins within the evaluation timeframe embrace insurance coverage large AXA, skilled companies firm KPMG, industrial automation firm Schneider Electrical, and brewing firm Heineken. AWS was second on this regard, with 207 (34%). Electronics large Samsung and meals and beverage producer Nestlé had been two notable new AWS AI clients. Google got here in third with 102 (17%), including clients comparable to pharmaceutical firm Merck and journey company Priceline.com. AWS had the best variety of conventional AI case research—i.e., not counting GenAI—at 176. Of observe, Google had the best share of recent AI case research in comparison with new total cloud case research—102 of 280 (36%).

Variety of AI case research relative to market share

Microsoft has the most important share level (pp) hole between the share of recent case research and market share. AWS’s share of recent cloud AI case research (34%) is 3 pp decrease than its 2023 cloud market share of 37%. Google’s case examine share of 17% is 8 pp larger than its cloud market share of 9%, whereas Microsoft’s case examine share of 45% is 16 pp larger than its 29% cloud market share. Microsoft and Google are thus outperforming their cloud market share.

2. Cloud GenAI tasks

206 new GenAI case research. The worldwide cloud tasks report and database contains 206 new GenAI case research—34% of total AI case research.

Whole variety of cloud GenAI case research

Microsoft leads with probably the most cloud GenAI case research. Of the 206 cloud GenAI case research, Microsoft takes a transparent lead with 127 case research (62% of the 206). Google is second on this regard, with 37 case research (18%), and AWS has 33 (16%).

Quantity or GenAI case examine relative to market share

Microsoft’s share of recent cloud GenAI case research far outweighs its cloud market share. AWS’s share of recent cloud GenAI case research (16%) is 21 pp decrease than its 2023 cloud market share of 37%. Google’s case examine share of 18% is 9 pp larger than its cloud market share of 9%, whereas Microsoft’s 62% share of recent GenAI case research was 33 pp larger than its 29% cloud market share. As soon as once more, Microsoft outperforms its friends on this facet of the cloud AI race.

Extra evaluation about cloud AI tasks

High cloud GenAI use case: Customer support

In keeping with the International Cloud Tasks Report and Database 2024, the highest use case for GenAI was subject decision for customer support/assist. An instance of that is UK-based multinational telecommunications firm Vodafone leveraging Microsoft Azure AI Studio, Azure OpenAI Service, and Microsoft Copilot—together with Azure AI Search—to construct on its current digital assistant, TOBi, to empower buyer care brokers to answer a number of questions shortly and broaden their experience.

Analyst takeaway: Who’s successful the cloud AI race?

Microsoft leads the cloud AI race typically and the GenAI race—for now. Because it stands, when evaluating new cloud AI case research in opposition to total cloud solid research, Microsoft has a transparent lead within the race and would possibly stay so within the close to time period. Serving to increase Microsoft into this spot is its important lead in cloud GenAI, pushed by its shut relationship with OpenAI. Microsoft was a huge backer of OpenAI in 2019, and in January 2023 (lower than two months since ChatGPT grew to become publicly accessible), it expanded the connection by rising funding and making the Azure OpenAI service usually accessible. Many massive enterprises have initiated their first GenAI tasks on high of a Microsoft AI stack. Nevertheless, with a number of LLMs closing the efficiency hole with OpenAI fashions, it stays to be seen if Microsoft’s early mover benefit fades or stays.

AWS leads with conventional AI. When cloud GenAI tasks are eliminated from the general cloud AI umbrella, the image turns into completely different. AWS is the chief when it comes to conventional cloud AI (i.e., cloud AI case research with out a GenAI component). Coinciding with this, AWS’s Amazon SageMaker—an AI/ML platform—was probably the most included product at 21% of cloud AI case research. As AWS additional develops its cloud AI choices (particularly GenAI), it might begin upselling these companies to its present and new buyer base, see extra cloud AI tasks, and achieve a bigger share of recent tasks.

Google has the best share of AI clients. Google, which has historically been common with smaller-sized corporations, additionally has its personal energy within the cloud AI race. When taking a look at new case research for every vendor, Google had the most important share of cloud AI case research relative to its total new case examine rely. 36% of Google’s new public cloud case research make use of a cloud AI product, implying that AI is an even bigger driver for Google Cloud than it’s for any of the opposite hyperscalers.

AI is driving cloud demand, however there are different drivers. Wanting forward usually, enterprise urge for food for AI functions might be pivotal, and the distributors providing probably the most or finest companies to assist these tasks stand to see market positive factors. Nevertheless, whereas AI is predicted to climb from the Eighth-ranked enterprise expertise precedence in 2024 to the 4th in 2025, cybersecurity has been and is predicted to stay the highest precedence for the foreseeable future. This, and lots of extra cloud undertaking insights, is mirrored within the International Cloud Tasks Report and Database 2024 as properly—when discounting new cloud AI case research, cloud safety companies (comparable to Microsoft Sentinel and Google Cloud Armor) are among the many fastest-growing merchandise over the previous 12 months.

Extra data and additional studying

Are you curious about studying extra concerning the cloud market?

International Cloud Tasks Report and Database 2024

A structured repository of 8,374 tasks from 5 of the most important cloud distributors, accompanied by a 188-page report analyzing buyer implementations, together with a deep dive into IoT and GenAI cloud tasks.

Obtain the pattern to be taught extra concerning the report construction, choose definitions, choose information, further information factors, developments, and extra.

Associated publications

You might also have an interest within the following studies:

Associated articles

You might also have an interest within the following articles:

Associated dashboard and trackers

You might also have an interest within the following dashboards and trackers:

Subscribe to our publication and comply with us on LinkedIn and Twitter to remain up-to-date on the most recent developments shaping the IoT markets. For full enterprise IoT protection with entry to all of IoT Analytics’ paid content material & studies inclu