On this publish, we current an answer that harnesses the facility of generative AI to streamline the person onboarding course of for monetary companies by a digital assistant. Onboarding new clients within the banking trade is an important step within the buyer journey, involving a sequence of actions designed to meet know your buyer (KYC) necessities, conduct needed verifications, and introduce them to the financial institution’s services or products. Historically, buyer onboarding has been a tedious and closely handbook course of. Our answer offers sensible steerage on addressing this problem by utilizing a generative AI assistant on AWS.

Amazon Bedrock is a totally managed service that provides a alternative of high-performing basis fashions (FMs) from main AI corporations like AI21 Labs, Anthropic, Cohere, Meta, Mistral AI, Stability AI, and Amazon by a single API, together with a broad set of capabilities you must construct generative AI functions with safety, privateness, and accountable AI. Utilizing Anthropic’s Claude 3.5 Sonnet on Amazon Bedrock, we construct a digital assistant that automates doc processing, identification verifications, and engages clients by conversational interactions. In consequence, clients could be onboarded in a matter of minutes by safe, automated workflows. On this publish we offer you an answer and the accompanying code that banks can use to dramatically improve the client expertise and set up a powerful buyer relationship from the outset.

Challenges with conventional onboarding

The normal onboarding course of for banks faces challenges within the present digital panorama as a result of many establishments don’t have absolutely automated account-opening techniques. Whereas clients in different sectors have entry to clever assistants, these in banking typically encounter legacy processes. Because the monetary companies trade adapts to altering shopper expectations, there’s a necessity to deal with the demand for fast and 24/7 availability of companies.

The challenges related to the handbook onboarding course of embrace however aren’t restricted to, the next:

- Time-consuming paperwork – New clients are requested to manually fill out in depth paperwork together with account opening types, disclosures, and so forth. Reviewing bodily paperwork additionally takes up beneficial employees time. This prolonged paperwork course of can lead to sluggish onboarding and a poor buyer expertise.

- Safety dangers – Paper paperwork and in-person ID verification lack safety in comparison with digital processes due to their susceptibility to tampering, loss, and lack of traceability. For instance, there’s a larger threat of identification theft and fraud with bodily paperwork, as a result of they are often altered or misplaced with out leaving an audit path.

- Accessibility points – Requiring in-person account opening at branches can create accessibility challenges for a lot of clients, together with senior residents and disabled people.

- Restricted service hours – The account opening course of is on the market solely throughout department working hours, which limits the timeframe when clients can full the onboarding course of. This constraint impacts the pliability for patrons to provoke account opening at their most popular time.

- Excessive prices – Handbook paperwork processing and in-person verification are labor-intensive duties that require vital employees time and sources, resulting in excessive operational prices.

AI-powered companies allow automated, safe, and compliant processes for self-service account opening. Offering onboarding experiences aligned with present digital requirements would possibly provide a aggressive edge for banks sooner or later.

Resolution overview

The answer permits customers to open financial institution accounts remotely by a conversational interface, eliminating the necessity to go to a bodily department. We created a digital assistant named Penny to information customers by the method, together with importing KYC paperwork and facilitating identification verification utilizing doc scanning and facial recognition. The method makes use of Retrieval Augmented Era (RAG), which mixes textual content technology capabilities with database querying to offer contextually related responses to buyer inquiries. Implementing digital onboarding reduces the accessibility limitations current in conventional handbook account opening processes. The code for this answer is on the market in a GitHub repository.

The mind of our utility is a customized LangChain Agent. When a person desires to open a brand new checking account, the agent will assist them full the onboarding course of utilizing preconfigured phases corresponding to every onboarding step. Every stage would possibly use a LangChain software, permitting for the automation and orchestration of onboarding. These instruments name on AWS service APIs for the required performance.

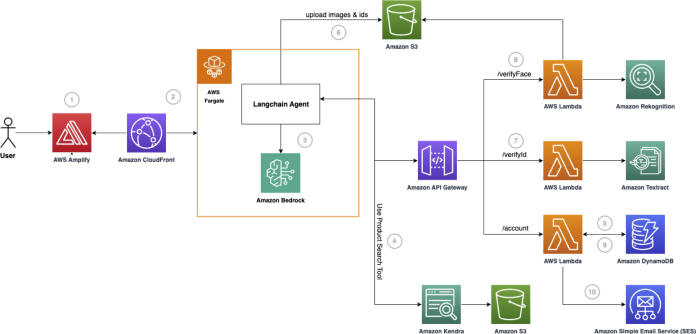

The next determine represents the high-level structure of the proposed answer.

The stream of the applying is as follows:

- Customers entry the frontend web site hosted inside AWS Amplify. AWS Amplify is an end-to-end answer that permits frontend internet builders to construct and deploy safe, scalable full stack functions.

- The web site invokes an Amazon CloudFront endpoint to work together with the digital assistant, Penny, which is containerized and deployed in AWS Fargate. Fargate is a serverless compute engine for containers that manages and scales your containers for you, appropriate with Amazon Elastic Container Service (Amazon ECS).

- The digital assistant makes use of a customized LangChain agent to reply questions on the financial institution’s services and orchestrate the onboarding stream.

- If the person asks a common query associated to the financial institution’s merchandise or service, the agent will use a customized LangChain software known as ProductSearch. This software makes use of Amazon Kendra linked with an Amazon Easy Storage Service (Amason S3) knowledge supply that comprises the financial institution’s knowledge. Amazon Kendra is an clever enterprise search service powered by machine studying that permits corporations to index and search content material throughout their doc shops.

- If the person signifies that they need to open a brand new account, the agent will immediate the person for his or her e-mail. After the person responds, the applying will invoke a customized LangChain software known as EmailValidation. This instruments checks if there may be an present account within the financial institution’s Amazon DynamoDB database, by calling an endpoint deployed in Amazon API Gateway.

- After the e-mail validation, KYC data is gathered, resembling first and final identify. Then, the person is prompted for an identification doc, which is uploaded to Amazon S3.

- The agent will invoke a customized LangChain software known as IDVerification. This software checks if the person particulars entered through the session match the ID by calling an endpoint deployed in Amazon API Gateway. The main points are verified by extracting the doc textual content utilizing Amazon Textract, a machine studying (ML) service that mechanically extracts textual content, handwriting, structure components, and knowledge from scanned paperwork.

- After the ID verification, the person is requested for a selfie. The picture is uploaded to Amazon S3. Then, the agent will invoke a customized LangChain software known as SelfieVerification. This software checks if the uploaded selfie matches the face on the ID by calling an endpoint deployed in API Gateway. The face match is detected utilizing Amazon Rekognition, which provides pre-trained and customizable laptop imaginative and prescient (CV) capabilities to extract data and insights out of your photographs and movies.

- After the face verification is profitable, the agent will use a customized LangChain software known as SaveData. This software creates a brand new account within the financial institution’s DynamoDB database by calling an endpoint deployed in API Gateway.

- The person is notified that their new account has been created efficiently, utilizing Amazon Easy Electronic mail Service (Amazon SES).

Immediate design for agent orchestration

Now, let’s check out how we give our digital assistant, Penny, the aptitude to deal with onboarding for monetary companies. The secret’s the immediate engineering for the customized LangChain agent. This has been laid out in PennyAgent.py. This immediate contains onboarding phases and related LangChain instruments that the agent would possibly want to finish the onboarding steps.

To start, we offer the agent with a reputation, function and firm.

Subsequent, we outline the assorted phases of onboarding and specify the respective instruments and anticipated responses. Having phases in a sequential and structured format whereas additionally offering consciousness of all potential phases helps the agent decide the onboarding stage with accuracy.

We append the instruments, their descriptions, and their response codecs to the immediate. When calling on a selected software, the agent can generate enter parameters as required. Entry to all of the instruments helps the agent determine the very best software alternative primarily based on the dialog stage.

We embrace some tips that the agent must comply with whereas producing outputs. Through the use of emotion-based immediate engineering, we reduce hallucinations and deviation from anticipated outputs. These tips had been chosen after in depth testing to attenuate edge circumstances and assist stop frequent agent errors.

The agent makes use of the ReAct framework to make choices about learn how to reply primarily based on person enter. ReAct offers the agent with a pondering construction, by which it selects essentially the most applicable software for a given activity. Such frameworks make LLM brokers versatile and adaptable to completely different use circumstances.

Based mostly on the stage descriptions and the instruments accessible, if the LLM generates a response that requires entry to an exterior software, then the response of the LLM will embrace Thought, Resolution, Motion, Motion Enter and Remark. The agent comes with a string matcher, which is able to detect Motion and Motion Enter from the LLM’s response and set off the respective software. Based mostly on the response from the software, the LLM with resolve whether or not to proceed with the Remaining Reply, after which the output shall be returned by the agent.

Lastly, we give the agent entry to the dialog historical past to higher resolve what stage the dialog is at the moment in. As well as, we additionally give entry to an agent scratchpad the place it could possibly retailer its thought processes to execute sure actions.

Orchestrating clever digital assistants requires considerate immediate engineering to deal with complicated duties. By structuring the dialog into phases, offering tooling, and setting tips, we allow the assistant to systematically full the onboarding course of. This method permits assistants to scale throughout use circumstances whereas sustaining accuracy. With the best guardrails, assistants can ship clean, reliable buyer experiences.

Immediate design is vital to unlocking the flexibility of LLMs for real-world automation. Amazon Bedrock Immediate Administration can be utilized to streamline the creation, analysis, versioning and testing of prompts. It will assist builders and immediate engineers save time by making use of the identical immediate to completely different onboarding processes. Once you create a immediate, you may choose a special mannequin for inference and alter the variables to acquire the best-suited outcomes for a wide range of workflows.

The next sections clarify learn how to deploy the answer in your AWS account.

Word: Working this workload would have an estimated hourly price of $1.34 for the Oregon (us-west-2) AWS Area. Examine the pricing particulars for every service to know the prices you would possibly be charged for various utilization tiers and useful resource configurations.

Setup

To deploy the agent, go to the venture Github Repository, and use the next directions:

- Make sure the pre-requisites are accomplished as talked about within the README.

- Deploy the answer together with the agent, instruments infrastructure, and demo utility—in that order—primarily based on the directions within the README.

- After the deployment is profitable, go to the outputted area the place the demo utility is operating. Now you can start testing the agent.

Testing the agent

Start your exploration by accessing the Amplify endpoint the place the demonstration is hosted. The demonstration incorporates an interactive chat interface, enabling you to have interaction in a conversational change with the digital assistant, Penny. Everytime you need to provoke a brand new occasion of the agent, refresh the online web page.

Let’s begin speaking to Penny:

- Enter

Hello

Penny will reply with a pleasant greeting

- Enter

What are the cutoff occasions to obtain wire transfers on the identical day?

Penny will use the ProductSearch software to search out the related data from the loaded product catalog. You possibly can attempt asking different questions in regards to the financial institution’s product or companies together with the AnyBank Journey Rewards Visa Infinite Card or New Automobile Loans.

- Enter

I want to open a brand new checking account

Penny will acknowledge that the account opening stream must be initiated and can proceed with step one, which is asking you for an e-mail handle.

- Enter the verified buyer e-mail you registered with the Amazon SES identification. For our demonstration, we’ll use

anup@check.com(parameterSesCustomerEmailused within the instance command to setup infrastructure)

Penny will take the e-mail handle and run the EmailValidation Instrument. If there may be an present account with this e-mail, it can ask you to retry. In any other case, it can transfer on to the following step which is gathering your account sort.

- Enter

I need a financial savings accountor point out that you really want a checking account.

Penny will report your account sort and transfer on to the KYC questions.

- Enter

Anup

Penny will report your first identify and proceed gathering the remaining KYC data.

- Enter

Ravi

It would report your final identify and immediate you for an ID subsequent. We used Ravi to match the ID doc supplied under.

- Obtain the image ID. It’s additionally situated at

./api/lambdas/check/passport.png

Add it to the chat by choosing Select File.

After importing the picture, you’ll obtain a affirmation message on the chat stating We now have acquired your doc. Penny will use ID Verification to match the identify entered through the session to the doc. After verification is full, Penny will immediate you to add a selfie.

- Add the selfie situated at

./api/lambdas/check/selfie.pngto the chat by choosing Select File.

After the add is full, you’ll obtain a affirmation message on the chat stating We now have acquired your doc. Penny will use Selfie Verification to match the face on the ID to the selfie for a face match. After verification is full, Penny will immediate you to substantiate that you simply need to proceed.

- Enter

Sure I verify

Penny will use Create Account to finish the onboarding course of and ship an e-mail affirmation. It would inform to you of this replace within the chat.

Examine the client e-mail you used. The e-mail handle specified because the SesCustomerEmail parameter (on this instance: anup@check.com) throughout setup will obtain a brand new e-mail from the e-mail handle you set because the SesBankEmail parameter (on this instance: proprietor@anybank.com).

- Go to the DynamoDB console, choose Desk from the navigation pane and choose the desk created by the AWS CloudFormation That is the accounts desk within the financial institution’s AWS account. From the Desk web page, select Discover gadgets. You will notice a brand new account created with the small print that you simply entered.

Guardrails and safety

Safety is a important a part of any utility and should be rigorously addressed when growing and deploying options, particularly people who contain dealing with delicate knowledge or interacting with customers. For an answer just like the instance on this publish, a number of sturdy safety measures needs to be carried out to keep up the confidentiality, integrity, and availability of the system.

- Handle the safety of the service itself. One method to mitigate potential biases, toxicity, or different undesirable outputs is to make use of Constitutional AI strategies, resembling these supplied by the LangChain library or Guardrails for Amazon Bedrock. By defining and imposing a algorithm or constraints, the system could be skilled to generate outputs that align with predefined moral ideas and values, thereby enhancing the trustworthiness and reliability of the service.

- To keep up knowledge safety and privateness, implementing a write-only database structure is advisable. On this setup, the agent or service can write knowledge to the database however is prohibited from studying or retrieving delicate saved data. This measure successfully isolates delicate person knowledge, ensuring that the agent could be unable to entry or disclose confidential particulars even within the occasion of a compromise.

- Immediate injection assaults, the place malicious inputs are crafted to control the system’s habits, are a severe concern in conversational AI techniques. To mitigate this threat, it’s essential to implement sturdy enter validation and sanitization mechanisms. This might embrace strategies like whitelisting permissible characters, filtering out probably dangerous patterns, and using context-aware enter processing.

- Safe coding practices, resembling enter validation, output encoding, and correct error dealing with, needs to be rigorously adopted all through the event course of. Common safety audits, penetration testing, and vulnerability assessments needs to be carried out to determine and handle potential weaknesses within the system.

- Amazon API Gateway, a totally managed service, securely handles API visitors, appearing as a entrance door for functions operating on AWS. It helps a number of safety mechanisms, together with AWS Identification and Entry Administration (IAM) for authentication and authorization, AWS WAF for internet utility safety, AWS Secrets and techniques Supervisor for securely storing and retrieving secrets and techniques, and integration with AWS CloudTrail for API exercise logging. API Gateway additionally helps client-side SSL certificates, API keys, and useful resource insurance policies for granular entry management.

- Communication between customers, the answer, and its inside dependencies needs to be protected utilizing TLS to encrypt knowledge in transit.

- Moreover, the info needs to be encrypted utilizing data-at-rest encryption with AWS Key Administration Service (AWS KMS) buyer managed keys (CMK).

By implementing these sturdy safety measures and fostering a tradition of steady safety consciousness and enchancment, the answer can higher shield towards potential threats, safeguard person privateness, and preserve the integrity and reliability of the service.

Cleanup

Comply with the cleanup Directions within the README of the Github repository to take away the surroundings out of your account.

Conclusion

On this publish, we offered an end-to-end answer that demonstrates how banks can remodel person onboarding with an AI-powered digital assistant. By orchestrating workflows throughout AWS companies, we enabled automated, safe account opening inside minutes. The conversational interface delivers distinctive buyer experiences whereas decreasing operational prices.

This answer could be shortly deployed and enhanced utilizing the options of Amazon Bedrock. Amazon Bedrock Brokers streamlines workflows by executing multistep duties and integrating with firm techniques and knowledge sources. Amazon Bedrock Data Bases offers contextual data from proprietary knowledge sources, enhancing the accuracy and relevance of responses. Moreover, Amazon Bedrock Guardrails implements safeguards to allow accountable AI utilization, filtering dangerous content material and defending delicate data. These can allow a strong and safe deployment of an AI-powered onboarding answer.

Key outcomes of this answer embrace:

- Absolutely digital onboarding with out paper types or department visits

- Automated KYC verification utilizing paperwork and facial recognition

- Clients onboarded securely in minutes with e-mail confirmations

- Decrease prices by decreasing handbook verification workloads

- Personalised help for any product questions 24/7

Instantaneous, safe, and scalable supply has change into the norm that clients demand. This AI assistant answer, powered by AWS, showcases the potential way forward for person onboarding for monetary establishments. As shopper behaviors and expectations proceed to be influenced by the most recent digital experiences throughout industries, banks that spend money on superior applied sciences will acquire a aggressive edge over their rivals.

Able to future proof your banking expertise? Go to Synthetic Intelligence and Machine studying for Monetary companies with AWS.

Concerning the authors

Anup Ravindranath is a Senior Options Architect at Amazon Internet Companies (AWS) primarily based in Toronto, Canada working with Monetary Companies organizations. He helps clients to rework their companies and innovate on cloud.

Anup Ravindranath is a Senior Options Architect at Amazon Internet Companies (AWS) primarily based in Toronto, Canada working with Monetary Companies organizations. He helps clients to rework their companies and innovate on cloud.

Arya Subramanyam is a Options Architect primarily based in Toronto, Canada. She works with Enterprise Greenfield clients in addition to Small & Medium companies as a technical advisor, serving to them resolve enterprise challenges with cloud options. Arya holds a Bachelor of Utilized Science in Pc Engineering from the College of British Columbia, Vancouver. Her ardour for Generative AI has led her to develop numerous options leveraging Giant Language Fashions (LLMs) with a give attention to immediate engineering and AI brokers.

Arya Subramanyam is a Options Architect primarily based in Toronto, Canada. She works with Enterprise Greenfield clients in addition to Small & Medium companies as a technical advisor, serving to them resolve enterprise challenges with cloud options. Arya holds a Bachelor of Utilized Science in Pc Engineering from the College of British Columbia, Vancouver. Her ardour for Generative AI has led her to develop numerous options leveraging Giant Language Fashions (LLMs) with a give attention to immediate engineering and AI brokers.

Venkata Satyanarayana Chivatam is a Options Architect at AWS. He focuses on Generative AI and Pc Imaginative and prescient, with a specific give attention to driving adoption throughout industries resembling healthcare and finance. At AWS, he helps ISV and SMB clients leverage cutting-edge AI applied sciences to unlock new potentialities and resolve complicated challenges. He’s keen about supporting companies of all sizes of their AI journey.

Venkata Satyanarayana Chivatam is a Options Architect at AWS. He focuses on Generative AI and Pc Imaginative and prescient, with a specific give attention to driving adoption throughout industries resembling healthcare and finance. At AWS, he helps ISV and SMB clients leverage cutting-edge AI applied sciences to unlock new potentialities and resolve complicated challenges. He’s keen about supporting companies of all sizes of their AI journey.

Akshata Ramesh Rao is a Options Architect in Toronto, Canada. Akshata works with enterprise clients to speed up innovation and advise them by technical challenges. She additionally loves working with SMB clients and assist them attain their enterprise targets shortly, safely, and cost-effectively with AWS companies, frameworks, and finest practices. Previous to becoming a member of AWS, Akshata labored as Devops Engineer at Amazon and holds a grasp’s diploma in laptop science from College of Ottawa.

Akshata Ramesh Rao is a Options Architect in Toronto, Canada. Akshata works with enterprise clients to speed up innovation and advise them by technical challenges. She additionally loves working with SMB clients and assist them attain their enterprise targets shortly, safely, and cost-effectively with AWS companies, frameworks, and finest practices. Previous to becoming a member of AWS, Akshata labored as Devops Engineer at Amazon and holds a grasp’s diploma in laptop science from College of Ottawa.