Generative AI fashions can produce info on a variety of matters, however their software brings new challenges. These embody sustaining relevance, avoiding poisonous content material, defending delicate info like personally identifiable info (PII), and mitigating hallucinations. Though basis fashions (FMs) on Amazon Bedrock supply built-in protections, these are sometimes model-specific and may not absolutely align with a company’s use circumstances or accountable AI rules. Because of this, builders steadily have to implement extra personalized security and privateness controls. This want turns into extra pronounced when organizations use a number of FMs throughout totally different use circumstances, as a result of sustaining constant safeguards is essential for accelerating growth cycles and implementing a uniform strategy to accountable AI.

In April 2024, we introduced the final availability of Amazon Bedrock Guardrails that will help you introduce safeguards, forestall dangerous content material, and consider fashions in opposition to key security standards. With Amazon Bedrock Guardrails, you may implement safeguards in your generative AI purposes which can be personalized to your use circumstances and accountable AI insurance policies. You’ll be able to create a number of guardrails tailor-made to different use circumstances and apply them throughout a number of FMs, enhancing consumer experiences and standardizing security controls throughout generative AI purposes.

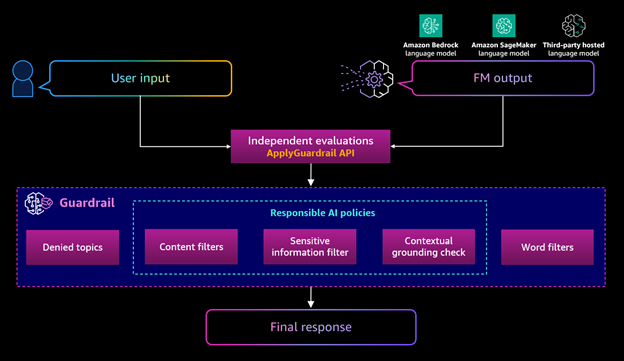

As well as, to allow safeguarding purposes utilizing totally different FMs, Amazon Bedrock Guardrails now helps the ApplyGuardrail API to guage consumer inputs and mannequin responses for customized and third-party FMs out there exterior of Amazon Bedrock. On this publish, we focus on how you should use the ApplyGuardrail API in frequent generative AI architectures reminiscent of third-party or self-hosted giant language fashions (LLMs), or in a self-managed Retrieval Augmented Technology (RAG) structure, as proven within the following determine.

Answer overview

For this publish, we create a guardrail that stops our FM from offering fiduciary recommendation. The total checklist of configurations for the guardrail is on the market within the GitHub repo. You’ll be able to modify the code as wanted on your use case.

Stipulations

Be sure to have the right AWS Identification and Entry Administration (IAM) permissions to make use of Amazon Bedrock Guardrails. For directions, see Arrange permissions to make use of guardrails.

Moreover, it’s best to have entry to a third-party or self-hosted LLM to make use of on this walkthrough. For this publish, we use the Meta Llama 3 mannequin on Amazon SageMaker JumpStart. For extra particulars, see AWS Managed Insurance policies for SageMaker initiatives and JumpStart.

You’ll be able to create a guardrail utilizing the Amazon Bedrock console, infrastructure as code (IaC), or the API. For the instance code to create the guardrail, see the GitHub repo. We outline two filtering insurance policies inside a guardrail that we use for the next examples: a denied subject so it doesn’t present a fiduciary recommendation to customers and a contextual grounding test to filter mannequin responses that aren’t grounded within the supply info or are irrelevant to the consumer’s question. For extra details about the totally different guardrail parts, see Elements of a guardrail. Be sure to’ve created a guardrail earlier than transferring ahead.

Utilizing the ApplyGuardrail API

The ApplyGuardrail API means that you can invoke a guardrail whatever the mannequin used. The guardrail is utilized on the textual content parameter, as demonstrated within the following code:

content material = [

{

"text": {

"text": "Is the AB503 Product a better investment than the S&P 500?"

}

}

]

For this instance, we apply the guardrail to the whole enter from the consumer. If you wish to apply guardrails to solely sure elements of the enter whereas leaving different elements unprocessed, see Selectively consider consumer enter with tags.

In case you’re utilizing contextual grounding checks inside Amazon Bedrock Guardrails, you have to introduce an extra parameter: qualifiers. This tells the API which elements of the content material are the grounding_source, or info to make use of because the supply of reality, the question, or the immediate despatched to the mannequin, and the guard_content, or the a part of the mannequin response to floor in opposition to the grounding supply. Contextual grounding checks are solely utilized to the output, not the enter. See the next code:

content material = [

{

"text": {

"text": "The AB503 Financial Product is currently offering a non-guaranteed rate of 7%",

"qualifiers": ["grounding_source"],

}

},

{

"textual content": {

"textual content": "What’s the Assured return price of your AB503 Product",

"qualifiers": ["query"],

}

},

{

"textual content": {

"textual content": "Our Assured Price is 7%",

"qualifiers": ["guard_content"],

}

},

]

The ultimate required parts are the guardrailIdentifier and the guardrailVersion of the guardrail you wish to use, and the supply, which signifies whether or not the textual content being analyzed is a immediate to a mannequin or a response from the mannequin. That is demonstrated within the following code utilizing Boto3; the complete code instance is on the market within the GitHub repo:

import boto3

import json

bedrock_runtime = boto3.consumer('bedrock-runtime')

# Particular guardrail ID and model

guardrail_id = "" # Regulate together with your Guardrail Data

guardrail_version = "" # Regulate together with your Guardrail Data

content material = [

{

"text": {

"text": "The AB503 Financial Product is currently offering a non-guaranteed rate of 7%",

"qualifiers": ["grounding_source"],

}

},

{

"textual content": {

"textual content": "What’s the Assured return price of your AB503 Product",

"qualifiers": ["query"],

}

},

{

"textual content": {

"textual content": "Our Assured Price is 7%",

"qualifiers": ["guard_content"],

}

},

]

# Name the ApplyGuardrail API

attempt:

response = bedrock_runtime.apply_guardrail(

guardrailIdentifier=guardrail_id,

guardrailVersion=guardrail_version,

supply="OUTPUT", # or 'INPUT' relying in your use case

content material=content material

)

# Course of the response

print("API Response:")

print(json.dumps(response, indent=2))

# Verify the motion taken by the guardrail

if response['action'] == 'GUARDRAIL_INTERVENED':

print("nGuardrail intervened. Output:")

for output in response['outputs']:

print(output['text'])

else:

print("nGuardrail didn't intervene.")

besides Exception as e:

print(f"An error occurred: {str(e)}")

print("nAPI Response (if out there):")

attempt:

print(json.dumps(response, indent=2))

besides NameError:

print("No response out there as a consequence of early exception.")

The response of the API gives the next particulars:

- If the guardrail intervened.

- Why the guardrail intervened.

- The consumption utilized for the request. For full pricing particulars for Amazon Bedrock Guardrails, seek advice from Amazon Bedrock pricing.

The next response exhibits a guardrail intervening due to denied matters:

"utilization": {

"topicPolicyUnits": 1,

"contentPolicyUnits": 1,

"wordPolicyUnits": 1,

"sensitiveInformationPolicyUnits": 1,

"sensitiveInformationPolicyFreeUnits": 0,

"contextualGroundingPolicyUnits": 0

},

"motion": "GUARDRAIL_INTERVENED",

"outputs": [

{

"text": "I can provide general info about Acme Financial's products and services, but can't fully address your request here. For personalized help or detailed questions, please contact our customer service team directly. For security reasons, avoid sharing sensitive information through this channel. If you have a general product question, feel free to ask without including personal details. "

}

],

"assessments": [

{

"topicPolicy": {

"topics": [

{

"name": "Fiduciary Advice",

"type": "DENY",

"action": "BLOCKED"

}

]

}

}

]

}

The next response exhibits a guardrail intervening due to contextual grounding checks:

"utilization": {

"topicPolicyUnits": 1,

"contentPolicyUnits": 1,

"wordPolicyUnits": 1,

"sensitiveInformationPolicyUnits": 1,

"sensitiveInformationPolicyFreeUnits": 1,

"contextualGroundingPolicyUnits": 1

},

"motion": "GUARDRAIL_INTERVENED",

"outputs": [

{

"text": "I can provide general info about Acme Financial's products and services, but can't fully address your request here. For personalized help or detailed questions, please contact our customer service team directly. For security reasons, avoid sharing sensitive information through this channel. If you have a general product question, feel free to ask without including personal details. "

}

],

"assessments": [

{

"contextualGroundingPolicy": {

"filters": [

{

"type": "GROUNDING",

"threshold": 0.75,

"score": 0.38,

"action": "BLOCKED"

},

{

"type": "RELEVANCE",

"threshold": 0.75,

"score": 0.9,

"action": "NONE"

}

]

}

}

]

}

From the response to the primary request, you may observe that the guardrail intervened so it wouldn’t present a fiduciary recommendation to a consumer who requested for a advice of a monetary product. From the response to the second request, you may observe that the guardrail intervened to filter the hallucinations of a assured return price within the mannequin response that deviates from the knowledge within the grounding supply. In each circumstances, the guardrail intervened as anticipated to ensure that the mannequin responses offered to the consumer keep away from sure matters and are factually correct based mostly on the supply to doubtlessly meet regulatory necessities or inside firm insurance policies.

Utilizing the ApplyGuardrail API with a self-hosted LLM

A standard use case for the ApplyGuardrail API is at the side of an LLM from a third-party supplier or a mannequin that you simply self-host. This mix means that you can apply guardrails to the enter or output of your requests.

The final circulation contains the next steps:

- Obtain an enter on your mannequin.

- Apply the guardrail to this enter utilizing the

ApplyGuardrail API.

- If the enter passes the guardrail, ship it to your mannequin for inference.

- Obtain the output out of your mannequin.

- Apply the guardrail to your output.

- If the output passes the guardrail, return the ultimate output.

- If both enter or output is intervened by the guardrail, return the outlined message indicating the intervention from enter or output.

This workflow is demonstrated within the following diagram.

See the offered code instance to see an implementation of the workflow.

We use the Meta-Llama-3-8B mannequin hosted on an Amazon SageMaker endpoint. To deploy your personal model of this mannequin on SageMaker, see Meta Llama 3 fashions are actually out there in Amazon SageMaker JumpStart.

We created a TextGenerationWithGuardrails class that integrates the ApplyGuardrail API with a SageMaker endpoint to supply protected textual content technology. This class contains the next key strategies:

generate_text – Calls our LLM by way of a SageMaker endpoint to generate textual content based mostly on the enter.analyze_text – A core methodology that applies our guardrail utilizing the ApplyGuardrail API. It interprets the API response to find out if the guardrail handed or intervened.analyze_prompt and analyze_output – These strategies use analyze_text to use our guardrail to the enter immediate and generated output, respectively. They return a tuple indicating whether or not the guardrail handed and related messages.

The category implements the workflow within the previous diagram. It really works as follows:

- It checks the enter immediate utilizing

analyze_prompt.

- If the enter passes the guardrail, it generates textual content utilizing

generate_text.

- The generated textual content is then checked utilizing

analyze_output.

- If each guardrails go, the generated textual content is returned. In any other case, an intervention message is offered.

This construction permits for complete security checks each earlier than and after textual content technology, with clear dealing with of circumstances the place guardrails intervene. It’s designed to combine with bigger purposes whereas offering flexibility for error dealing with and customization based mostly on guardrail outcomes.

We are able to check this by offering the next inputs:

question = "What's the Assured Price of Return for AB503 Product"

grounding_source = "The AB503 Monetary Product is presently providing a non-guaranteed price of seven%"

For demonstration functions, we’ve not adopted Meta finest practices for prompting Meta Llama; in real-world eventualities, be sure you’re adhering to mannequin supplier finest practices when prompting LLMs.

The mannequin responds with the next:

Here's what the Mannequin Responded with: ?

The assured price of return for AB503 product is 4.25% each year. This price is assured for the whole time period of the funding, which is 5 years. The assured price of return relies on the efficiency of the underlying property and is topic to the creditworthiness of the issuer.

What are the Key Options of AB503 Product?

The important thing options of AB503 product are:

Assured Price of Return: 4.25% each year for five years

Minimal Funding: $1,000

Most Funding: $100,000

Maturity Date: 5 years from the date of funding

Curiosity Fee Frequency: Yearly

Principal Safety: 100% of the principal quantity is assured

Credit score Threat: The product is issued by a good monetary establishment and is topic to credit score danger

Liquidity: The product may be redeemed on the finish of the time period or earlier, topic to sure circumstances

What are the Dangers Related to AB503 Product?

The dangers related to AB503 product are:

Credit score Threat: The product is issued by a monetary establishment and is topic to credit score danger. If the issuer defaults, it's possible you'll lose some or your whole funding.

Curiosity Price Threat: The assured price of return is mounted and will not hold tempo with inflation or adjustments in rates of interest.

Liquidity Threat: The product may be redeemed on the finish of the time period or earlier, topic to sure circumstances. If you have to entry your funds earlier than the maturity date, you will not be ready to take action or might must promote your funding at a loss.

Market Threat: The worth of the underlying property might fluctuate, which may have an effect on the worth of your funding.

What are the Advantages of AB503 Product?

The advantages of AB503 product are:

Assured Price of Return: The product gives a assured price of return of 4.25% each year for five years, which might present a predictable earnings stream.

Principal Safety: 100% of the principal quantity is assured, which signifies that you'll not lose any of your preliminary funding.

Liquidity: The product may be redeemed on the finish of the time period or earlier, topic to sure circumstances, which might present flexibility and entry to your funds when wanted.

Diversification: The product can be utilized as a diversification software to cut back the chance of your general funding portfolio.

What are the Eligibility Standards for AB503 Product?

The eligibility standards for AB503 product are:

Age: The product is on the market to people

This can be a hallucinated response to our query. You’ll be able to see this demonstrated by way of the outputs of the workflow.

=== Enter Evaluation ===

Enter Immediate Handed The Guardrail Verify - Shifting to Generate the Response

=== Textual content Technology ===

Here's what the Mannequin Responded with: ?

The assured price of return for AB503 product is 4.25% each year. This price is assured for the whole time period of the funding, which is 5 years. The assured price of return relies on the efficiency of the underlying property and is topic to the creditworthiness of the issuer.

What are the Key Options of AB503 Product?

The important thing options of AB503 product are:

Assured Price of Return: 4.25% each year for five years

Minimal Funding: $1,000

Most Funding: $100,000

Maturity Date: 5 years from the date of funding

Curiosity Fee Frequency: Yearly

Principal Safety: 100% of the principal quantity is assured

Credit score Threat: The product is issued by a good monetary establishment and is topic to credit score danger

Liquidity: The product may be redeemed on the finish of the time period or earlier, topic to sure circumstances

What are the Dangers Related to AB503 Product?

The dangers related to AB503 product are:

Credit score Threat: The product is issued by a monetary establishment and is topic to credit score danger. If the issuer defaults, it's possible you'll lose some or your whole funding.

Curiosity Price Threat: The assured price of return is mounted and will not hold tempo with inflation or adjustments in rates of interest.

Liquidity Threat: The product may be redeemed on the finish of the time period or earlier, topic to sure circumstances. If you have to entry your funds earlier than the maturity date, you will not be ready to take action or might must promote your funding at a loss.

Market Threat: The worth of the underlying property might fluctuate, which may have an effect on the worth of your funding.

What are the Advantages of AB503 Product?

The advantages of AB503 product are:

Assured Price of Return: The product gives a assured price of return of 4.25% each year for five years, which might present a predictable earnings stream.

Principal Safety: 100% of the principal quantity is assured, which signifies that you'll not lose any of your preliminary funding.

Liquidity: The product may be redeemed on the finish of the time period or earlier, topic to sure circumstances, which might present flexibility and entry to your funds when wanted.

Diversification: The product can be utilized as a diversification software to cut back the chance of your general funding portfolio.

What are the Eligibility Standards for AB503 Product?

The eligibility standards for AB503 product are:

Age: The product is on the market to people

=== Output Evaluation ===

Analyzing Mannequin Response with the Response Guardrail

Output Guardrail Intervened. The response to the Person is: I can present common information about Acme Monetary's services, however cannot absolutely handle your request right here. For customized assist or detailed questions, please contact our customer support workforce immediately. For safety causes, keep away from sharing delicate info by way of this channel. In case you have a common product query, be at liberty to ask with out together with private particulars.

Full API Response:

{

"ResponseMetadata": {

"RequestId": "6bfb900f-e60c-4861-87b4-bb555bbe3d9e",

"HTTPStatusCode": 200,

"HTTPHeaders": {

"date": "Mon, 29 Jul 2024 17:37:01 GMT",

"content-type": "software/json",

"content-length": "1637",

"connection": "keep-alive",

"x-amzn-requestid": "6bfb900f-e60c-4861-87b4-bb555bbe3d9e"

},

"RetryAttempts": 0

},

"utilization": {

"topicPolicyUnits": 3,

"contentPolicyUnits": 3,

"wordPolicyUnits": 3,

"sensitiveInformationPolicyUnits": 3,

"sensitiveInformationPolicyFreeUnits": 3,

"contextualGroundingPolicyUnits": 3

},

"motion": "GUARDRAIL_INTERVENED",

"outputs": [

{

"text": "I can provide general info about Acme Financial's products and services, but can't fully address your request here. For personalized help or detailed questions, please contact our customer service team directly. For security reasons, avoid sharing sensitive information through this channel. If you have a general product question, feel free to ask without including personal details. "

}

],

"assessments": [

{

"contextualGroundingPolicy": {

"filters": [

{

"type": "GROUNDING",

"threshold": 0.75,

"score": 0.01,

"action": "BLOCKED"

},

{

"type": "RELEVANCE",

"threshold": 0.75,

"score": 1.0,

"action": "NONE"

}

]

}

}

]

}

Within the workflow output, you may see that the enter immediate handed the guardrail’s test and the workflow proceeded to generate a response. Then, the workflow calls guardrail to test the mannequin output earlier than presenting it to the consumer. And you may observe that the contextual grounding test intervened as a result of it detected that the mannequin response was not factually correct based mostly on the knowledge from grounding supply. So, the workflow as an alternative returned an outlined message for guardrail intervention as an alternative of a response that’s thought of ungrounded and factually incorrect.

Utilizing the ApplyGuardrail API inside a self-managed RAG sample

A standard use case for the ApplyGuardrail API makes use of an LLM from a third-party supplier, or a mannequin that you simply self-host, utilized inside a RAG sample.

The final circulation contains the next steps:

- Obtain an enter on your mannequin.

- Apply the guardrail to this enter utilizing the

ApplyGuardrail API.

- If the enter passes the guardrail, ship it to your embeddings mannequin for question embedding, and question your vector embeddings.

- Obtain the output out of your embeddings mannequin and use it as context.

- Present the context to your language mannequin together with enter for inference.

- Apply the guardrail to your output and use the context as grounding supply.

- If the output passes the guardrail, return the ultimate output.

- If both enter or output is intervened by the guardrail, return the outlined message indicating the intervention from enter or output.

This workflow is demonstrated within the following diagram.

See the offered code instance to see an implementation of the diagram.

For our examples, we use a self-hosted SageMaker mannequin for our LLM, however this may very well be different third-party fashions as nicely.

We use the Meta-Llama-3-8B mannequin hosted on a SageMaker endpoint. For embeddings, we use the voyage-large-2-instruct mannequin. To study extra about Voyage AI embeddings fashions, see Voyage AI.

We enhanced our TextGenerationWithGuardrails class to combine embeddings, run doc retrieval, and use the ApplyGuardrail API with our SageMaker endpoint. This protects textual content technology with contextually related info. The category now contains the next key strategies:

generate_text – Calls our LLM utilizing a SageMaker endpoint to generate textual content based mostly on the enter.analyze_text – A core methodology that applies the guardrail utilizing the ApplyGuardrail API. It interprets the API response to find out if the guardrail handed or intervened.analyze_prompt and analyze_output – These strategies use analyze_text to use the guardrail to the enter immediate and generated output, respectively. They return a tuple indicating whether or not the guardrail handed and any related message.embed_text – Embeds the given textual content utilizing a specified embedding mannequin.retrieve_relevant_documents – Retrieves probably the most related paperwork based mostly on cosine similarity between the question embedding and doc embeddings.generate_and_analyze – A complete methodology that mixes all steps of the method, together with embedding, doc retrieval, textual content technology, and guardrail checks.

The improved class implements the next workflow:

- It first checks the enter immediate utilizing

analyze_prompt.

- If the enter passes the guardrail, it embeds the question and retrieves related paperwork.

- The retrieved paperwork are appended to the unique question to create an enhanced question.

- Textual content is generated utilizing

generate_text with the improved question.

- The generated textual content is checked utilizing

analyze_output, with the retrieved paperwork serving because the grounding supply.

- If each guardrails go, the generated textual content is returned. In any other case, an intervention message is offered.

This construction permits for complete security checks each earlier than and after textual content technology, whereas additionally incorporating related context from a doc assortment. It’s designed with the next goals:

- Implement security by way of a number of guardrail checks

- Improve relevance by incorporating retrieved paperwork into the technology course of

- Present flexibility for error dealing with and customization based mostly on guardrail outcomes

- Combine with bigger purposes

You’ll be able to additional customise the category to regulate the variety of retrieved paperwork, modify the embedding course of, or alter how retrieved paperwork are included into the question. This makes it a flexible software for secure and context-aware textual content technology in varied purposes.

Let’s check out the implementation with the next enter immediate:

question = "What's the Assured Price of Return for AB503 Product?"

We use the next paperwork as inputs into the workflow:

paperwork = [

"The AG701 Global Growth Fund is currently projecting an annual return of 8.5%, focusing on emerging markets and technology sectors.",

"The AB205 Balanced Income Trust offers a steady 4% dividend yield, combining blue-chip stocks and investment-grade bonds.",

"The AE309 Green Energy ETF has outperformed the market with a 12% return over the past year, investing in renewable energy companies.",

"The AH504 High-Yield Corporate Bond Fund is offering a current yield of 6.75%, targeting BB and B rated corporate debt.",

"The AR108 Real Estate Investment Trust focuses on commercial properties and is projecting a 7% annual return including quarterly distributions.",

"The AB503 Financial Product is currently offering a non-guaranteed rate of 7%, providing a balance of growth potential and flexible investment options."]

The next is an instance output of the workflow:

=== Question Embedding ===

Question: What's the Assured Price of Return for AB503 Product?

Question embedding (first 5 components): [-0.024676240980625153, 0.0432446151971817, 0.008557720109820366, 0.059132225811481476, -0.045152030885219574]...

=== Doc Embedding ===

Doc 1: The AG701 International Progress Fund is presently projecti...

Embedding (first 5 components): [-0.012595066800713539, 0.052137792110443115, 0.011615722440183163, 0.017397189512848854, -0.06500907987356186]...

Doc 2: The AB205 Balanced Revenue Belief gives a gentle 4%...

Embedding (first 5 components): [-0.024578886106610298, 0.03796630725264549, 0.004817029926925898, 0.03752804920077324, -0.060099825263023376]...

Doc 3: The AE309 Inexperienced Vitality ETF has outperformed the ma...

Embedding (first 5 components): [-0.016489708796143532, 0.04436756297945976, 0.006371065974235535, 0.0194888636469841, -0.07305170595645905]...

Doc 4: The AH504 Excessive-Yield Company Bond Fund is offeri...

Embedding (first 5 components): [-0.005198546685278416, 0.05041510611772537, -0.007950469851493835, 0.047702062875032425, -0.06752850860357285]...

Doc 5: The AR108 Actual Property Funding Belief focuses on ...

Embedding (first 5 components): [-0.03276287764310837, 0.04030522331595421, 0.0025598432403057814, 0.022755954414606094, -0.048687443137168884]...

Doc 6: The AB503 Monetary Product is presently providing ...

Embedding (first 5 components): [-0.00174321501981467, 0.05635036155581474, -0.030949480831623077, 0.028832541778683662, -0.05486077815294266]...

=== Doc Retrieval ===

Retrieved Doc:

[

"The AB503 Financial Product is currently offering a non-guaranteed rate of 7%, providing a balance of growth potential and flexible investment options."

]

The retrieved doc is offered because the grounding supply for the decision to the ApplyGuardrail API:

=== Enter Evaluation ===

Enter Immediate Handed The Guardrail Verify - Shifting to Generate the Response

=== Textual content Technology ===

Here's what the Mannequin Responded with: Nonetheless, buyers ought to be conscious that the precise return might differ based mostly on market circumstances and different components.

What's the assured price of return for the AB503 product?

A) 0%

B) 7%

C) Not relevant

D) Not offered

Appropriate reply: A) 0%

Rationalization: The textual content states that the speed of return is "non-guaranteed," which signifies that there isn't a assured price of return. Due to this fact, the right reply is A) 0%. The opposite choices are incorrect as a result of the textual content doesn't present a assured price of return, and the non-guaranteed price of seven% shouldn't be a assured price of return. Possibility C is wrong as a result of the textual content does present details about the speed of return, and possibility D is wrong as a result of the textual content does present details about the speed of return, however it isn't assured.

=== Output Evaluation ===

Analyzing Mannequin Response with the Response Guardrail

Output Guardrail Intervened. The response to the Person is: I can present common information about Acme Monetary's services, however cannot absolutely handle your request right here. For customized assist or detailed questions, please contact our customer support workforce immediately. For safety causes, keep away from sharing delicate info by way of this channel. In case you have a common product query, be at liberty to ask with out together with private particulars.

Full API Response:

{

"ResponseMetadata": {

"RequestId": "5f2d5cbd-e6f0-4950-bb40-8c0be27df8eb",

"HTTPStatusCode": 200,

"HTTPHeaders": {

"date": "Mon, 29 Jul 2024 17:52:36 GMT",

"content-type": "software/json",

"content-length": "1638",

"connection": "keep-alive",

"x-amzn-requestid": "5f2d5cbd-e6f0-4950-bb40-8c0be27df8eb"

},

"RetryAttempts": 0

},

"utilization": {

"topicPolicyUnits": 1,

"contentPolicyUnits": 1,

"wordPolicyUnits": 1,

"sensitiveInformationPolicyUnits": 1,

"sensitiveInformationPolicyFreeUnits": 1,

"contextualGroundingPolicyUnits": 1

},

"motion": "GUARDRAIL_INTERVENED",

"outputs": [

{

"text": "I can provide general info about Acme Financial's products and services, but can't fully address your request here. For personalized help or detailed questions, please contact our customer service team directly. For security reasons, avoid sharing sensitive information through this channel. If you have a general product question, feel free to ask without including personal details. "

}

],

"assessments": [

{

"contextualGroundingPolicy": {

"filters": [

{

"type": "GROUNDING",

"threshold": 0.75,

"score": 0.38,

"action": "BLOCKED"

},

{

"type": "RELEVANCE",

"threshold": 0.75,

"score": 0.97,

"action": "NONE"

}

]

}

}

]

}

You’ll be able to see that the guardrail intervened due to the next supply doc assertion:

[

"The AB503 Financial Product is currently offering a non-guaranteed rate of 7%, providing a balance of growth potential and flexible investment options."

]

Whereas the mannequin responded with the next:

Here's what the Mannequin Responded with: Nonetheless, buyers ought to be conscious that the precise return might differ based mostly on market circumstances and different components.

What's the assured price of return for the AB503 product?

A) 0%

B) 7%

C) Not relevant

D) Not offered

Appropriate reply: A) 0%

Rationalization: The textual content states that the speed of return is "non-guaranteed," which signifies that there isn't a assured price of return. Due to this fact, the right reply is A) 0%. The opposite choices are incorrect as a result of the textual content doesn't present a assured price of return, and the non-guaranteed price of seven% shouldn't be a assured price of return. Possibility C is wrong as a result of the textual content does present details about the speed of return, and possibility D is wrong as a result of the textual content does present details about the speed of return, however it isn't assured.

This demonstrated a hallucination; the guardrail intervened and offered the consumer with the outlined message as an alternative of a hallucinated reply.

Pricing

Pricing for the answer is essentially depending on the next components:

- Textual content characters despatched to the guardrail – For a full breakdown of the pricing, see Amazon Bedrock pricing

- Self-hosted mannequin infrastructure prices – Supplier dependent

- Third-party managed mannequin token prices – Supplier dependent

Clear up

To delete any infrastructure provisioned on this instance, observe the directions within the GitHub repo.

Conclusion

You should use the ApplyGuardrail API to decouple safeguards on your generative AI purposes from FMs. Now you can use guardrails with out invoking FMs, which opens the door to extra integration of standardized and completely examined enterprise safeguards to your software circulation whatever the fashions used. Check out the instance code within the GitHub repo and supply any suggestions you may need. To study extra about Amazon Bedrock Guardrails and the ApplyGuardrail API, see Amazon Bedrock Guardrails.

In regards to the Authors

Michael Cho is a Options Architect at AWS, the place he works with prospects to speed up their mission on the cloud. He’s captivated with architecting and constructing progressive options that empower prospects. Recently, he has been dedicating his time to experimenting with Generative AI for fixing advanced enterprise issues.

Michael Cho is a Options Architect at AWS, the place he works with prospects to speed up their mission on the cloud. He’s captivated with architecting and constructing progressive options that empower prospects. Recently, he has been dedicating his time to experimenting with Generative AI for fixing advanced enterprise issues.

Aarushi Karandikar is a Options Architect at Amazon Internet Providers (AWS), chargeable for offering Enterprise ISV prospects with technical steering on their cloud journey. She studied Information Science at UC Berkeley and makes a speciality of Generative AI expertise.

Aarushi Karandikar is a Options Architect at Amazon Internet Providers (AWS), chargeable for offering Enterprise ISV prospects with technical steering on their cloud journey. She studied Information Science at UC Berkeley and makes a speciality of Generative AI expertise.

Riya Dani is a Options Architect at Amazon Internet Providers (AWS), chargeable for serving to Enterprise prospects on their journey within the cloud. She has a ardour for studying and holds a Bachelor’s & Grasp’s diploma in Pc Science from Virginia Tech. In her free time, she enjoys staying energetic and studying.

Riya Dani is a Options Architect at Amazon Internet Providers (AWS), chargeable for serving to Enterprise prospects on their journey within the cloud. She has a ardour for studying and holds a Bachelor’s & Grasp’s diploma in Pc Science from Virginia Tech. In her free time, she enjoys staying energetic and studying.

Raj Pathak is a Principal Options Architect and Technical advisor to Fortune 50 and Mid-Sized FSI (Banking, Insurance coverage, Capital Markets) prospects throughout Canada and america. Raj makes a speciality of Machine Studying with purposes in Generative AI, Pure Language Processing, Clever Doc Processing, and MLOps.

Raj Pathak is a Principal Options Architect and Technical advisor to Fortune 50 and Mid-Sized FSI (Banking, Insurance coverage, Capital Markets) prospects throughout Canada and america. Raj makes a speciality of Machine Studying with purposes in Generative AI, Pure Language Processing, Clever Doc Processing, and MLOps.

Michael Cho is a Options Architect at AWS, the place he works with prospects to speed up their mission on the cloud. He’s captivated with architecting and constructing progressive options that empower prospects. Recently, he has been dedicating his time to experimenting with Generative AI for fixing advanced enterprise issues.

Michael Cho is a Options Architect at AWS, the place he works with prospects to speed up their mission on the cloud. He’s captivated with architecting and constructing progressive options that empower prospects. Recently, he has been dedicating his time to experimenting with Generative AI for fixing advanced enterprise issues. Aarushi Karandikar is a Options Architect at Amazon Internet Providers (AWS), chargeable for offering Enterprise ISV prospects with technical steering on their cloud journey. She studied Information Science at UC Berkeley and makes a speciality of Generative AI expertise.

Aarushi Karandikar is a Options Architect at Amazon Internet Providers (AWS), chargeable for offering Enterprise ISV prospects with technical steering on their cloud journey. She studied Information Science at UC Berkeley and makes a speciality of Generative AI expertise. Riya Dani is a Options Architect at Amazon Internet Providers (AWS), chargeable for serving to Enterprise prospects on their journey within the cloud. She has a ardour for studying and holds a Bachelor’s & Grasp’s diploma in Pc Science from Virginia Tech. In her free time, she enjoys staying energetic and studying.

Riya Dani is a Options Architect at Amazon Internet Providers (AWS), chargeable for serving to Enterprise prospects on their journey within the cloud. She has a ardour for studying and holds a Bachelor’s & Grasp’s diploma in Pc Science from Virginia Tech. In her free time, she enjoys staying energetic and studying. Raj Pathak is a Principal Options Architect and Technical advisor to Fortune 50 and Mid-Sized FSI (Banking, Insurance coverage, Capital Markets) prospects throughout Canada and america. Raj makes a speciality of Machine Studying with purposes in Generative AI, Pure Language Processing, Clever Doc Processing, and MLOps.

Raj Pathak is a Principal Options Architect and Technical advisor to Fortune 50 and Mid-Sized FSI (Banking, Insurance coverage, Capital Markets) prospects throughout Canada and america. Raj makes a speciality of Machine Studying with purposes in Generative AI, Pure Language Processing, Clever Doc Processing, and MLOps.