Briefly

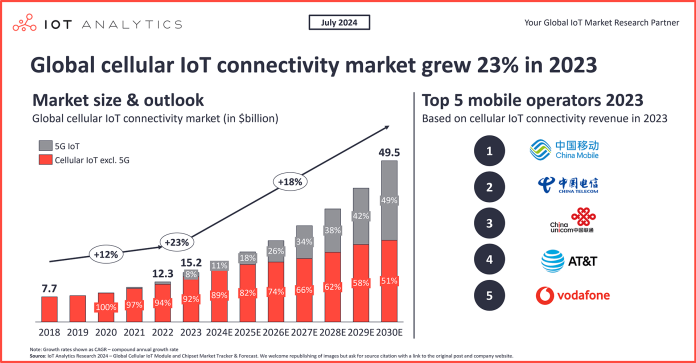

- Cell operators worldwide earned a mixed $15 billion from 3.6 billion mobile IoT connections in 2023– in line with IoT Analytics’ International Mobile IoT Connectivity Tracker & Forecast (up to date June 2024) and IoT Cell Operator Pricing & Market Report 2024–2030 (launched July 2024).

- Cell operators’ IoT income progress price of 23% YoY exceeded that of IoT software program firms and hyperscalers in 2023.

- Mobile IoT connections grew even whereas the shipments and income for mobile IoT modules declined globally in 2023.

- The highest 5 cellular IoT community operators managed 83% of all world mobile IoT connections, whereas the highest 5 by income acquired 64% of mixed income.

- 5G and 5G Redcap are prone to drive the worldwide mobile IoT market’s forecasted 18% CAGR between 2024 and 2030.

Why it issues

- For cellular operators: Market information informs strategic IoT service design, enabling new income channels, community optimization for progress, and partnerships for rising IoT markets.

- For chipset/module/system makers: Market intelligence drives product portfolio growth for high-demand IoT applied sciences. Collaboration with cellular operators expands market attain and ensures easy integration inside the IoT ecosystem.

This text relies on insights from these publications:

Market overview

Cell operators worldwide earned $15 billion from 3.56 billion mobile IoT connections in 2023. In line with IoT Analytics’ International Mobile IoT Connectivity Tracker & Forecast (up to date in June 2024)—which shares granular information about connections, income, and ARPU throughout all IoT connectivity varieties, together with 2024 quarterly forecasts—cellular operator IoT income grew at a CAGR of 16% since 2010. IoT Analytics tasks progress acceleration beginning in 2024, with the CAGR anticipated to exceed 18% by means of 2030.

Cell IoT income progress price set the tempo in 2023. The IoT income progress price for cellular operators exceeded that for software program distributors and hyperscalers basically in 2023, in line with IoT Analytics’ International IoT Enterprise Spending dashboard (up to date June 2024). This information level exhibits that the relative significance of mobile connectivity for IoT-connected units continues to extend.

The marketplace for mobile IoT connections grew whereas the marketplace for mobile IoT modules declined. In 2023, mobile IoT module distributors noticed a ten% decline in income year-over-year (YoY) stemming from a decline in module shipments. Nonetheless, mobile IoT connectivity income grew 23% YoY, supporting IoT Analytics’ current evaluation that the mobile IoT module market decline resulted from stock methods to stop overstocking. Demand for LTE Cat 1 bis and 5G in China has fueled an upswing within the mobile IoT module market.

Prime 5 cellular operators by connections and income

The highest 5 community operators managed 83% of all world mobile IoT connections in 2023. These prime 5 are China Cell, China Telecom, China Unicom, Vodafone, and AT&T. When it comes to IoT income, the highest 5 community operators made up 64% of the IoT cellular operator market, with China Cell, Verizon, AT&T, China Unicom, and Deutsche Telekom (together with T-Cell) main the market.

Key insights on 2023 market developments of main cellular IoT operators:

- China Cell. China Cell contributed 46% of world mobile IoT connections and 20% of world mobile IoT connectivity income in 2023. China Cell’s mobile IoT connections grew by 20% YoY as a result of its one-stop answer technique, shifting focus from pure connectivity to complete options. Its one-stop answer technique encompasses {hardware} elements like chips, working programs, and modules. It additionally integrates with three key IoT platforms—OneLink, OneNET, and OneCyber—and targets three primary areas of software: video-based IoT, city IoT, and industrial IoT.

- China Telecom. China Telecom contributed 15% of world mobile IoT connections and seven% of world mobile IoT connectivity income. China Telecom’s mobile IoT connection grew by 28% YoY as a result of a concentrate on city administration options leveraging the IoT Cognition Cloud Platform, empowering over 100 use instances for city administration. These use instances vary from flood-level detection to fireside safety, offering a complete view of a metropolis’s standing, together with facets equivalent to warmth distribution, location and situation, alert statistics, and facility situations.

- China Unicom. China Unicom contributed 14% of world mobile IoT connections and 10% of world mobile IoT connectivity income. China Unicom’s mobile IoT connection grew by 28% YoY as a result of adoption of 4G and 5G high-speed applied sciences. Notably, deploying 5G IoT connections led to China Unicom’s progress.

- Vodafone. Vodafone contributed 5% of world mobile IoT connections and 9% of world mobile IoT connectivity income. Vodafone’s mobile IoT connection grew by 15% YoY as a result of sturdy demand from the automotive sector.

- AT&T. AT&T contributed 4% of world mobile IoT connections and 12% of world mobile IoT connectivity income. AT&T’s mobile IoT connection grew by 19% YoY as a result of sturdy demand from the automotive sector.

IoT connectivity worth factors fluctuate by area. In line with IoT Analytics’ 159-page IoT Cell Operator Pricing and Market Report 2024–2030 (revealed in July 2024 with its accompanying non-compulsory IoT Operator Pricing Database), Western cellular operators firms like AT&T, Verizon, Deutsche Telekom, and others provide mobile IoT information plans at comparatively larger worth factors than the worldwide common, resulting in larger income even with fewer IoT connections. Nonetheless, China Cell leads in each income and the variety of connections.

Word: Together with the IoT Cell Operator Pricing and Market Report 2024–2030, IoT Analytics launched its IoT Operator Pricing Database in July 2024, made obtainable with an enterprise premium license. The database accommodates data on 150 IoT connectivity plans—with 300,000 information factors—from 14 cellular community operators and seven cellular digital community operators, which serves as the idea for the evaluation in its accompanying report.

Future outlook: 5G and 5G Redcap to drive IoT connectivity market progress

5G and 5G RedCap to contribute practically 50% of cellular operator IoT connectivity income by 2030. Primarily based on the IoT connectivity tracker, IoT Analytics forecasts 5G and 5G RedCap will drive the worldwide mobile IoT connectivity market as much as a CAGR of 18% from 2024 to 2030 as they improve their mixed market income share to a close to majority by the tip of this timeframe. In line with IoT Analytics’ 367-page 5G IoT & Non-public 5G Market Report 2024–2030 (revealed in June 2024), 5G IoT connections are forecasted to develop at a CAGR of 44% from 2024 to 2030.

Flexibility and cost-effectiveness drive 5G RedCap adoption. IoT units embedded with the RedCap module don’t require tight or deterministic latency as in time-critical communications purposes. Such units require a knowledge price of lower than 150 Mbps for obtain and fewer than 50 Mbps for add, with a latency of lower than 100ms. This reduces the complexity of the units and retains the prices down, resulting in a noticeable improve in client, enterprise, and industrial units utilizing 5G RedCap hitting the market. Most notably, 5G RedCap’s use in video surveillance is gaining recognition, because it gives enough uplink information charges required for video cameras to transmit high-quality video streams with out requiring the complete capabilities (and prices) of normal 5G.

Analyst opinion

“5G RedCap is about to rework the IoT panorama by making 5G options extra accessible and supporting quite a few purposes, from industrial IoT to Shopper IoT. Its design optimizations, equivalent to diminished channel bandwidth and capped modulation order, improve system effectivity and cost-effectiveness. Driving on present 5G infrastructure, RedCap ensures the longevity of present deployments and eases the transition to next-generation connectivity. It outperforms LTE Cat-1 and Cat-4, with higher uplink efficiency and prolonged battery life, assembly the crucial wants of mid-speed use instances like wearables and good cameras.”

Satyajit Sinha, principal analyst at IoT Analytics

What it means for cellular operators providing IoT providers

8 questions executives at cellular operators providing IoT providers ought to ask themselves primarily based on the insights on this article:

- Income diversification: How can we diversify our IoT service choices to seize a bigger share of the $15 billion IoT connectivity market?

- Market share enlargement: What methods can we implement to extend our market share and compete extra successfully with the highest 5 cellular IoT community operators?

- 5G and 5G RedCap adoption: How can we speed up the deployment and adoption of 5G and 5G RedCap to capitalize on the forecasted 18% CAGR within the mobile IoT market?

- Automotive sector alternatives: What particular steps can we take to extend our presence and income within the automotive sector, following Vodafone and AT&T’s success?

- Deployment methods: How ought to we regulate our deployment technique of pure-play connectivity to complete options?

- Partnerships and collaborations: What potential partnerships and collaborations ought to we pursue to boost our IoT service choices and increase our market attain?

- IoT platform integration: How can we combine our IoT options with key IoT platforms to supply complete options and entice extra clients?

- Shopper and enterprise options: What progressive client, enterprise, and industrial options can we develop to leverage the rising adoption of 5G RedCap and meet market calls for?

What it means for mobile IoT module, chipset, and system producers

5 questions executives at firms manufacturing mobile IoT modules, chipsets, or units ought to ask themselves primarily based on the insights on this article:

- 5G and 5G RedCap readiness: How can we speed up the event and integration of 5G and 5G RedCap modules to seize a big share of the forecasted 18% CAGR within the IoT market?

- Market demand: What particular calls for from the automotive sector and different industries can we handle with our IoT modules and units to drive progress?

- Pricing methods: What changes to our pricing methods can we implement to align with market expectations and improve our income share?

- Partnership alternatives: Which cellular operators and different stakeholders ought to we companion with to increase our market attain and improve product integration inside the IoT ecosystem?

- Future applied sciences: What rising applied sciences and developments ought to we concentrate on to make sure our product portfolio stays related and aggressive within the quickly evolving IoT market?

Extra data and additional studying

Are you interested by studying extra in regards to the mobile IoT connectivity market?

This text relies on insights from these publications:

Associated dashboard and trackers

You might also have an interest within the following dashboards and trackers:

Associated publications

You might also have an interest within the following stories:

Associated articles

You might also have an interest within the following articles:

Subscribe to our e-newsletter and comply with us on LinkedIn and Twitter to remain up-to-date on the most recent developments shaping the IoT markets. For full enterprise IoT protection with entry to all of IoT Analytics’ paid content material & stories together with devoted analyst time try Enterprise subscription.

Satyajit is a principal analyst in our Hamburg, Germany workplace. He leads the {hardware} and connectivity analysis group, specializing in IoT elements, chips, modules and different {hardware}, together with IoT connectivity and safety.