Briefly

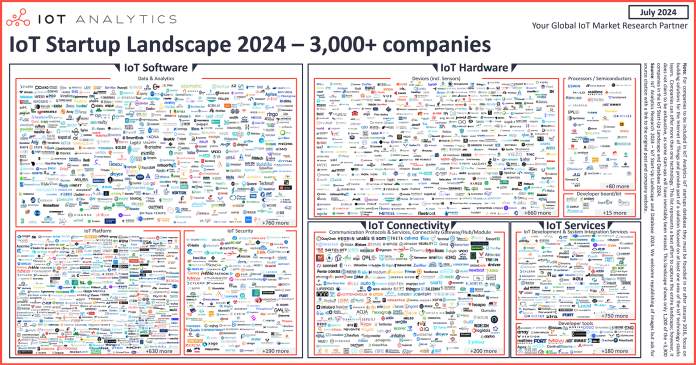

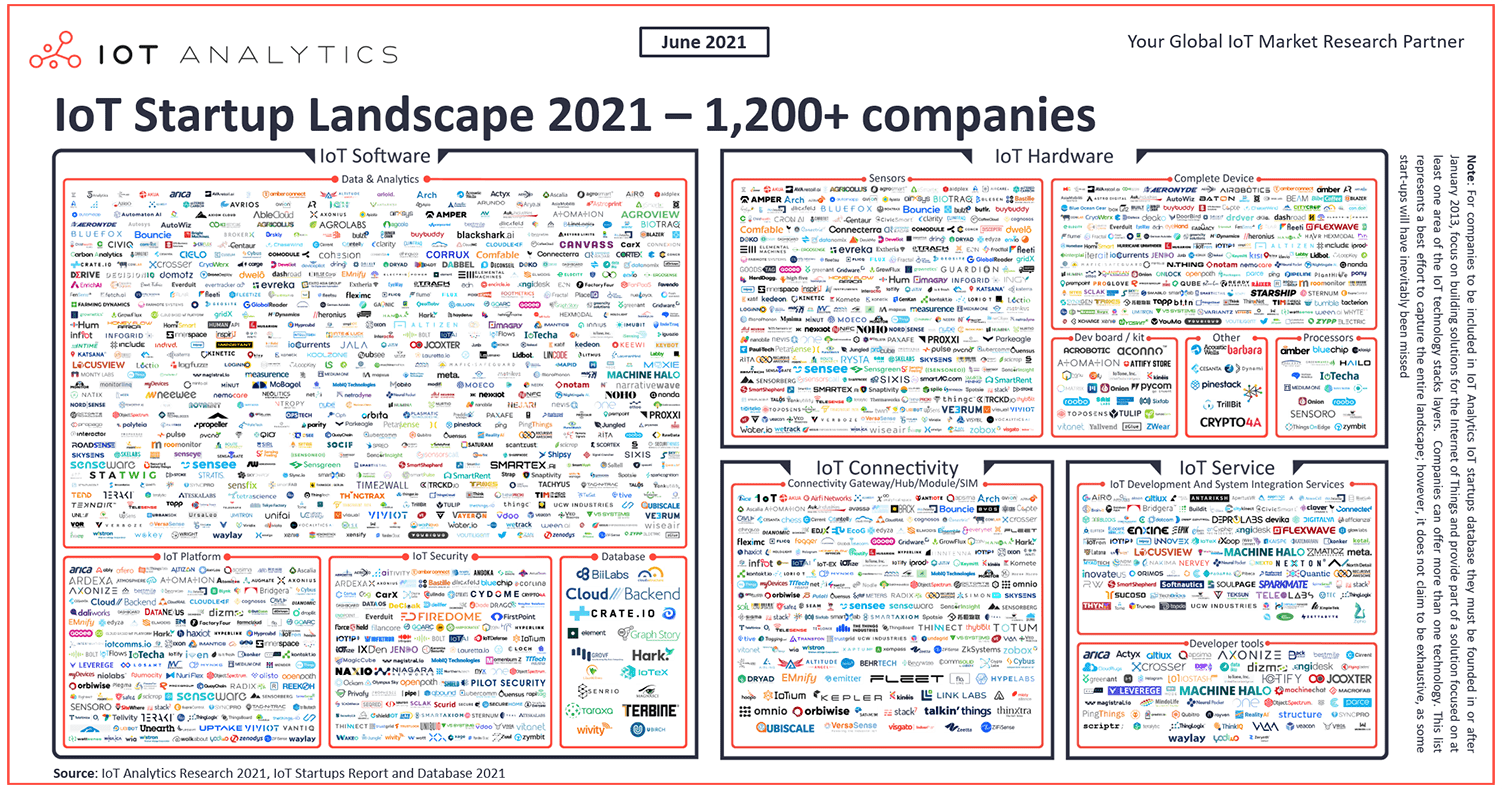

- There are over 3,300 energetic IoT startups, in accordance with the most recent 83-page IoT Startup Panorama 2024 Report and Database—a steep rise over the 1,205 recognized in 2021.

- 7 notable insights standout concerning the IoT startup panorama 2024: 1) Growing share of startups in APAC, 2) A Chinese language firm has the best funding, 3) Massive investments into particular person IoT {hardware} startups, 4) Techstars stays the highest investor, 5) Shifting focus towards cities and power/utilities, 6) AI taking a foothold, and seven) Analytics is the most typical providing.

Why it issues

- For IoT traders & corporates: The IoT startup panorama has turn into fairly dynamic over the previous couple of years, with many new, attention-grabbing, modern firms rising world wide. There at the moment are hundreds of attention-grabbing start-ups to spend money on or purchase.

- For IoT startups: With over 3,300 IoT startups, competitors is heating up and not using a notable improve in exits. Differentiating an IoT startup is turning into tougher.

IoT startup panorama overview in 2024

The variety of recognized energetic IoT startups rose 2.7x between 2021 and 2024. Analysis for IoT Analytics’ 83-page IoT Startup Panorama 2024 Report and Database recognized over 3,300 IoT startups—a steep rise over the 1,205 recognized energetic startups in 2021. Whereas a part of this comes right down to IoT Analytics’ extra refined methodology to search out all attainable startups in 2024, this improve highlights the vibrancy of the IoT neighborhood.

Be aware: The IoT Startup Panorama 2024 report contains the database from which the report attracts. It accommodates greater than 60 knowledge factors for every startup.

This text is predicated on insights from:

IoT Startup Panorama and Database 2024

Obtain a pattern to study extra concerning the database construction, report contents, further knowledge factors, and obtain the excessive decision model of the IoT startups panorama 2024.

Already a subscriber? See your studies right here →

7 notable analysis insights

The IoT startups report gives a extra detailed panorama overview with deep dives into IoT startup knowledge by expertise, area, and trade (with the accompanying database providing extra granular knowledge). Moreover, the IoT Analytics analyst group identifies their high 17 IoT startups and the the reason why. Among the many many insights that may be derived from the report, listed below are 7 that stand out:

1. The share of IoT startups in APAC is rising

North America has essentially the most IoT startups, however Asia is gaining. Of the three,300 recognized startups, 36% are in North America, down from 41% in 2021. In the meantime, 24% of IoT startups are within the Asia-Pacific (APAC) area, up from 16% in 2021, reflecting diversification within the IoT startup panorama. Whereas the variety of IoT startups in each tracked APAC nation rose, India noticed the best climb in comparison with 2021, from 84 to 388.

2. US-based IoT startups high complete funding share, however a Chinese language IoT startup leads general

The highest 20 IoT startups collectively acquired 31% of all investments. Between 2016 and 2024, the highest 20 IoT startups acquired almost $6.7 billion in funding. Whereas 11 of the 20 high funding earners had been within the US, the China-based semiconductor firm Eswin Computing acquired over $1 billion—the one firm to move the $1 billion mark. The second and third high funding earners are each from the US: Determine and Verkada.

IoT startup highlight: Eswin Computing

Based in 2016, Eswin Computing develops built-in chips and focuses on IoT connectivity and AI knowledge processing, amongst different areas. Particularly for mobile IoT functions, Eswin produces WAN IoT ICs that function underneath Cat.1 and Cat1 bis connectivity protocols, that are in style in China and have helped gas the latest upswing within the mobile IoT module market.

3. A number of giant funding rounds for IoT {hardware} startups

Massive funding quantities for IoT semiconductor and robotics startups. Capital-intensive investments into robotics and IoT semiconductor startups have seen a notable rise lately. Aforementioned Eswin Computing is one such firm that has benefitted from the push for extra chips submit Covid—in 2021, it raised $473.7 million Collection B and a further $395.2 million Collection C. The continued expert labor scarcity has given rise to new robotics startups . US-based Determine fashioned in 2022 to assist firms deal with these points by growing humanoid robots. It has raised an enormous $675 million in Collection B simply this yr.

IoT startup highlight: Determine

US-based Determine is the highest-funded IoT startup in North America. Leveraging AI and human-like agility in its engineering, Determine develops autonomous, general-purpose humanoid robots aimed toward serving to firms deal with workforce challenges comparable to labor shortages or unsafe job duties. In January 2024, Determine signed a business settlement with BMW to establish preliminary use circumstances for the robots after which deploy the developed robots to BMW’s manufacturing facility in Spartanburg, South Carolina.

4. Techstars stays the highest IoT startup investor

Techstars continues to steer in IoT startup investments by a protracted shot. As of April 2024,US-based enterprise capital agency Techstars had invested in 73 still-active IoT startups based between 2016 and 2024. That is greater than double the quantity of IoT startup investments from the US Nationwide Science Basis—a federal company that helps analysis and schooling throughout the sciences and engineering—which got here in second with 31 investments in still-active IoT startups based between 2016 and 2024. In IoT Analytics’ 2021 analysis into IoT startups, Techstars was the lead investor, whereas EASME (an EU initiative) was #2 and the EU-based Startup Bootcamp was #4. This time, no EU-based investor within the high 5.

IoT startup highlight: Wakeo

France-based Wakeo is one among Techstar’s largest IoT startup investments, as of April 2024. The startup supplies a software-as-a-service platform to assist transportation firms keep real-time visibility of their transport flows. Their answer not solely helps firms optimize transport plans but additionally helps them measure and scale back transportation-related emissions, giving it a sustainability focus as properly.

5. Manufacturing receives essentially the most consideration from IoT startups, however sensible city- and power/utility-focused startups achieve traction

Over 1 / 4 of startups deal with the manufacturing trade, however deal with cities and utilities is rising. Not too long ago, there was a shift within the focus of newly based IoT startups from the manufacturing trade to sectors like sensible cities and power/utilities. Whereas the general share of energetic IoT startups concentrating on the manufacturing trade stays roughly 36%—nonetheless the best—latest years present a declining development. In 2023, solely 28% of newly based IoT startups focused the manufacturing sector, down from 33% in 2021 and a peak of 40% in 2017.

In the meantime, the shares of IoT startups specializing in different sectors are rising. As an illustration, the general shares for energetic IoT startups concentrating on sensible cities and power/utilities are roughly 10% every. Nonetheless, in 2023, 13% of recent IoT startups focused sensible cities, up from 11% in 2021, whereas 13% centered on power/utilities, rising from 7% in 2021. These developments counsel a shift within the goal markets of newly based IoT startups.

IoT startup highlight: ZARIOT

Eire-based ZARIOT is an IoT connectivity supplier, specializing in safety and defending knowledge over cell community infrastructure. Based in 2018, it covers a variety of segments, together with sensible cities and power/utilities.

One instance of ZARIOT’s sensible cities initiatives is their partnership with vadeCity, a Spain-based city-mobility-focused small-to-medium enterprise aiming to assist firms obtain their sustainability targets. vadeCity’s bicycle and scooter system—all-in-one parking and charging stations for shared, non-public bicycles, e-bikes, and scooters—depends on cell networks and 3-point safety measures to guard non-public and public property, which is the place ZARIOT is available in with their deal with cell safety.

6. AI taking a foothold

Over 5% of IoT startups worldwide are centered on AI-based options. Of the three,330 IoT startups which are at present energetic, solely 175 (5.3%) have a visual AI focus as a part of their IoT providing. IoT Analytics believes this quantity will improve strongly within the coming months and years, because the urge for food for AIoT improvements in enterprises is robust and innovation in new fields typically comes from startups. APAC has the best share of AI-focused IoT startups at 6.3% of the area’s complete startups.

IoT startup highlight: ai-omatic

Germany-based ai-omatic is a deep-tech startup specializing in cloud- and AI-based software program options for predictive upkeep. At Hannover Messe 2024, ai-omatic showcased its AI-powered predictive upkeep answer Digital Upkeep Assistant utilizing a sensor related to a motor. Firm representatives highlighted that the answer gathers knowledge instantly from factory-level operations and leverages AI to investigate the info.

7. Analytics is the most typical providing

3 in 5 IoT startups provide analytics. Many IoT startups cowl greater than one of many 13 components of the IoT tech stack. Analytics stands out because the topmost lined expertise ingredient, with 61% of IoT startups providing it.

IoT startup highlight: H2Ok Improvements

US-based H2Ok Improvements assists firms with data- and analytics-driven optimization of commercial liquid and fluid techniques utilized in provide chain and manufacturing processes. Via H2Ok Innovation’s distinctive end-to-end answer comprising proprietary spectral sensors, machine studying on the edge, and an AI-based knowledge analytics platform, firms can acquire and analyze the info they want for correct liquid administration.

What it means for startups

5 questions that startup founders ought to ask themselves primarily based on the insights on this article:

- Market positioning: How can we differentiate our startup within the more and more aggressive IoT panorama?

- Investor engagement: How can we successfully interact main IoT startup traders like Techstars, and what key features of our startup ought to we spotlight to draw their funding?

- Trade focus: Ought to we goal the historically dominant manufacturing sector, or pivot in the direction of rising sectors like sensible cities and power/utilities the place there may be rising curiosity?

- AI Integration: How can we incorporate AI into our IoT options to capitalize on the rising development of AIoT, and what particular AI-based options can set us aside from opponents?

- Sustainability initiatives: How can we combine sustainability into our IoT options, just like Wakeo’s platform for optimizing transport flows and decreasing emissions, to enchantment to environmentally aware purchasers and traders?

What it means for tech traders

5 questions that tech traders ought to ask themselves primarily based on the insights on this article:

- Market developments: How is the rising share of IoT startups in APAC affecting the worldwide market dynamics, and what alternatives or challenges does this current for potential investments?

- Sector focus: With the shift from manufacturing to sensible cities and power/utilities, which sector holds essentially the most potential for progress and return on funding within the coming years?

- AI integration: Given the rising significance of AI in IoT startups, how can I establish startups which are successfully integrating AI to supply modern and scalable options?

- Sustainability affect: How do startups specializing in sustainability, like Wakeo, evaluate by way of funding potential and long-term affect to these focusing purely on technological developments?

- Aggressive panorama: How can I assess the aggressive panorama of the IoT sector to establish which startups have a singular worth proposition and a aggressive edge over others?

Disclosure

Firms talked about on this article—together with their merchandise—are used as examples to showcase a vibrant IoT startup panorama. No firm paid or acquired preferential remedy on this article, and it’s on the discretion of the analyst to pick out which examples are used. IoT Analytics makes efforts to fluctuate the businesses and merchandise talked about to assist shine consideration to the quite a few IoT and associated expertise market gamers.

It’s price noting that IoT Analytics might have business relationships with some firms talked about in its articles, as some firms license IoT Analytics market analysis. Nonetheless, for confidentiality, IoT Analytics can’t disclose particular person relationships. Please contact compliance@iot-analytics.com for any questions or issues on this entrance.

How IoT Analytics defines IoT startups

For the needs of the IoT Startup Panorama 2024 Report and Database and this text, IoT Analytics defines an IoT startup as an organization that’s no older than 8 years, has not had an preliminary public providing (IPO), and has not been acquired. These firms should additionally deal with constructing options in at the very least one space of the IoT tech stack—{hardware}, connectivity, middleware and software program infrastructure, and companies.

IoT Analytics distinguishes 13 tech providing varieties among the many 4 areas of the IoT tech stack:

- IoT {hardware}

- Processors/semiconductors

- Gadgets (together with sensors)

- Developer boards/kits

- Different {hardware}

- Full machine

- IoT connectivity

- Communication protocols and companies

- Connectivity gateways/hubs/modules

- IoT middleware and software program infrastructure

- IoT platforms

- Analytics

- IoT safety

- Databases

- IoT companies

- Software growth

- IoT growth and system integration companies

Analysis methodology

IoT Analytics compiled the info for the IoT Startups Database 2024. The foundational datasets had been sourced from publicly accessible hyperlinks on the web by means of desktop analysis utilizing varied sources. All stats within the report and this text are as of April 2024.

Be aware: This text updates the beforehand shared IoT startups panorama with the most recent knowledge and insights from IoT Analytics.

Click on to learn earlier analyses

Extra info and additional studying

Are you interested by studying extra concerning the IoT market?

IoT Startup Panorama and Database 2024

An in depth database classifying over 3,300 rising IoT expertise firms, inclusive of 17 standout startups handpicked by analysts. Accompanied by an 83-page insights report.

Already a subscriber?

Browse your studies here →

Associated publications

You may additionally have an interest within the following studies:

Associated dashboard and trackers

You may additionally have an interest within the following dashboards and trackers:

Associated articles

You may additionally have an interest within the following articles:

Subscribe to our publication and observe us on LinkedIn and Twitter to remain up-to-date on the most recent developments shaping the IoT markets. For full enterprise IoT protection with entry to all of IoT Analytics’ paid content material & studies together with devoted analyst time take a look at Enterprise subscription.