In 2016 Telesat made a wager that their future progress would relaxation with the concept of constructing a low Earth orbit satellite tv for pc constellation which might develop into often known as Lightspeed.

Based on the newest Novaspace report on Satellite tv for pc Connectivity & Video Market, the Non-Geostationary Satellite tv for pc Orbit (NGSO) market, which incorporates Telesat’s Lightspeed, will see revenues surpass the geostationary orbit market in 2028. The wager Telesat made seems to repay, although it’s taken for much longer than anticipated.

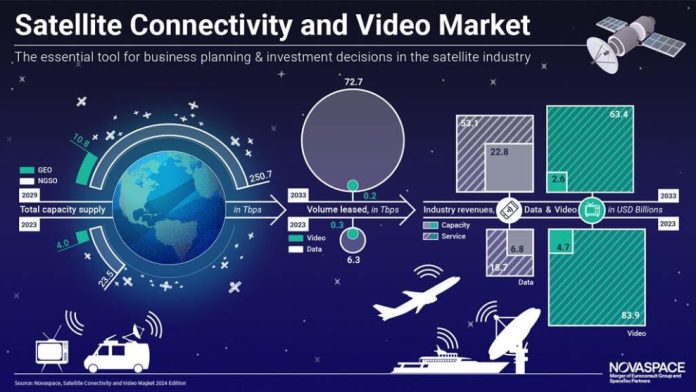

Novaspace stated “GEO capability nonetheless represented round 85% of capability revenues in 2023, although NGSO capability revenues are projected to develop at a Compound Annual Development Price (CAGR) of 27%, surpassing GEO revenues by 2028 and wringing in round $18 billion by 2033.”

Based on Novaspace “The previous three years have seen a dramatic eightfold improve in international satellite tv for pc capability provide, reaching round 27 Tbps in 2023, a determine accounted for over 80% by Starlink. This dominance may be partially attributed to delays from preliminary goal dates from most different constellation initiatives and software-defined satellites. Nevertheless, new Low Earth Orbit (LEO) constellations comparable to Telesat Lightspeed, and Amazon Kuiper, alongside second-generation constellations for Starlink and Eutelsat OneWeb, and Very Excessive Throughput Satellites (VHTS) like Viasat-3, are anticipated to drive progress to 260 Tbps by 2029.”

Satellite tv for pc operators have been taking a “wait and see” strategy with as NGSO programs elevated and with Geostationary Earth Orbit (GEO) orders declining steadily.

Dimitri Buchs, Supervisor at Novaspace and lead creator stated, “Dealing with a shifting panorama marked by declining demand for video broadcasting, fluctuating mobility market patterns, and an inflow of capability from NGSO constellations, satcom operators have been exploring completely different methods to outlive.”””

“With a purpose to increase market attain, diversify service choices, and improve enterprise resilience, capability suppliers have been more and more forming ‘multi-orbit’ partnerships. Market segments with lower cost sensitivity, comparable to aero In-Flight Connectivity (IFC) and army communications are anticipated to drive the vast majority of demand for multi-orbit connectivity options. General, multi-orbit service revenues are anticipated to succeed in almost $5 billion by 2033.”